The Mortgage Collaborative’s New Podcast ‘The Sip’ Delivers Industry Insights and Peer Collaboration

SAN DIEGO, Calif. /California Newswire/ -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced the launch of its new weekly podcast, "The Sip," designed to give mortgage professionals direct access to peers solving the same challenges they face every day. From tech adoption and compliance pressure to margin management, the 30-minute series delivers real-world strategies shared by lenders, for lenders-streamed live every Tuesday on LinkedIn.

Yiftee Inc. Enables Contactless ‘Tap & Go’ Payments – Teams with Silicon Valley Bank

MENLO PARK, Calif. /California Newswire / -- Yiftee, a leading provider of Community Cards that "Keep Local Dollars Local," announced the launch of contactless Tap & Go capabilities for their virtual Community Cards that support over 700 communities and over 20,000 local businesses. Developed with Mastercard and Silicon Valley Bank, a division of First Citizens Bank, this latest innovation is expected to help drive spending to local shops and restaurants across the country, fueling the "shop local" movement.

Joel Brouwer Honored as CFO of the Year at 2025 LA Executive Leadership Awards

LA VERNE, Calif. /California Newswire/ -- Hillcrest, an age-qualified community in La Verne, proudly announces that Chief Financial Officer Joel Brouwer, CPA, CGMA, has been recognized as the CFO of the Year in the Small to Midsize Company category at the 2025 LA Executive Leadership Awards, an event celebrating leaders across Southern California who exemplify excellence, vision and resilience.

Cloudvirga enhances mortgage lending efficiency with Encompass Docs Solution integration

IRVINE, Calif. /California Newswire/ -- Cloudvirga, a Stewart-owned provider of digital point-of-sale platforms for lenders, today announced a new integration using the latest API framework for mortgage technology from Intercontinental Exchange, Inc. (NYSE: ICE), a leading global provider of data, technology and market infrastructure. Available via the Marketplace in the ICE digital lending platform, the integration expands the document provider options available to Cloudvirga customers and enhances lender efficiency and compliance by streamlining the generation, delivery and management of initial and revised disclosures.

IRS Solutions Announces New Discrepancy Report Feature: Helps Tax, Financial, and Legal Pros

VALENCIA, Calif. /California Newswire/ -- IRS Solutions®, the trusted name in tax resolution software, announces the launch of its latest innovation, the Discrepancy Report. This cutting-edge feature is designed to simplify the detection of discrepancies between filed tax returns and income data reported to the IRS by third parties. This will empower tax professionals to prevent audits while delivering exceptional service to their clients proactively.

U.S. Mortgage Lenders Lifted by Collaboration During Extended Period of Margin Compression, Regulatory Chaos, and Technology Transformation, reports The Mortgage Collaborative

SAN DIEGO, Calif. /California Newswire/ -- Navigating a prolonged era of complexity marked by compressed margins, fierce recruiting wars, regulatory uncertainty, and rapid technological transformation, mortgage lenders find guidance and support in collaboration, according to The Mortgage Collaborative (TMC), an industry-leading organization for mortgage lenders of every variety.

The Mortgage Collaborative (TMC) Welcomes New Lender Members and Preferred Partners to Its Expanding 2025 Network

SAN DIEGO, Calif. /California Newswire/ -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, proudly announces the addition of several new lender members and preferred partners to its growing community. These organizations join TMC's network of industry leaders committed to collaboration, innovation, and operational excellence.

Secured Signing Integrates with NetDocuments to Revolutionize Legal Document Signing in U.S.

MOUNTAIN VIEW, Calif. /California Newswire/ -- Secured Signing, a global leader in digital signatures and Remote Online Notarization (RON) solutions, proudly announces its seamless integration with NetDocuments, the premier cloud-based document management system (DMS) tailored for legal, financial, and professional services firms. This collaboration empowers users to efficiently handle eSignatures and online notarizations without leaving the NetDocuments platform, revolutionizing workflows while bolstering security and ensuring compliance.

CapitalW Collective and Citizens Collaborate to Advance Women in Mortgage Capital Markets

SAN DIEGO, Calif. /California Newswire/ -- CapitalW Collective, a leading non-profit dedicated to increasing the representation of women and their allies in mortgage capital markets, proudly announces Citizens as a Diamond-level corporate sponsor. This partnership reflects a shared commitment to fostering a more inclusive and dynamic mortgage capital markets industry by providing education, mentorship, and leadership opportunities, particularly for underrepresented professionals.

Collaboration Between MCT and Fannie Mae to Improve Pricing for Mortgage Sellers on Select Loans

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced their integration with Fannie Mae's new Loan Pricing API. By combining various price factors and utilizing a broader set of data found in bid tapes, the new API provides greater price transparency on certain loans. This is the latest in a series of recent collaborations between MCT and Fannie Mae intended to provide additional benefit and value to mortgage secondary market participants.

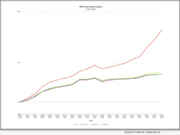

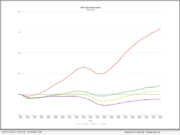

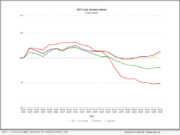

MCT Reports 28% Increase in Mortgage Lock Volume Heading into Spring 2025

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced a 27.91% increase in mortgage lock volume compared to the previous month. Industry professionals and stakeholders are encouraged to download the full report for a detailed analysis.

IRS Solutions Named as an American Society of Tax Problem Solvers (ASTPS) Partner

VALENCIA, Calif. /California Newswire/ -- IRS Solutions, a company offering innovative tax resolution software explicitly designed for tax professionals, announces that it has been named an industry partner by the prestigious American Society of Tax Problem Solvers (ASTPS).

Cloudvirga completes an enhanced integration with ICE Mortgage Technology

IRVINE, Calif. /California Newswire/ -- Cloudvirga, a leading provider of digital mortgage point-of-sale platforms, today announced Cloudvirga's Horizon Retail POS integration using Encompass Partner Connect, the latest API framework for mortgage technology from Intercontinental Exchange (ICE). This modern framework enables industry participants to integrate to ICE solutions and provide their services to loan originators and servicers through secure API-enabled technology.

MCT Introduces Atlas, a new Generative AI Advisor for Mortgage Capital Markets

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of Atlas, an artificial intelligence (AI) advisor now available within the MCTlive! platform. Atlas serves as a virtual capital markets expert and high-quality educational resource for MCT's mortgage lender clients. With this launch, effective February 10, 2025, MCT continues its tradition of innovation in secondary marketing technology.

2024-2025 Mortgage Industry Insights Report Released by The Mortgage Collaborative (TMC)

SAN DIEGO, Calif. /California Newswire/ -- The Mortgage Collaborative (TMC), a leading network of mortgage lenders dedicated to innovation and collaboration, has released its latest Pulse of the Network report, offering key insights into the challenges and opportunities shaping the mortgage industry in 2025. The survey, conducted with decision-makers-including CEOs, COOs, and department heads from banks, credit unions, and independent mortgage banks (IMBs)-highlights how lenders are preparing for a shifting market landscape.

Informative Research Integrates with Thomas & Co, Expanding Mortgage Verification Platform Connectivity

GARDEN GROVE, Calif. /California Newswire/ -- Informative Research, a premier technology provider delivering data-driven credit and verification solutions to the lending community, today announced its integration with Thomas & Company, a leading provider of value-added employer services and innovative solutions to support employee relations programs. The integration adds Thomas & Company's Wage and Employment Verification service to Informative Research's verification platform.

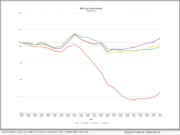

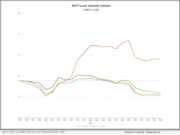

Mortgage Lock Volume Stays Flat in MCT February 2025 Indices Report

SAN DIEGO, Calif. /California Newswire / -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 0.12% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report for a deeper understanding of the latest market trends and dynamics.

Optimal Blue Releases Ask Obi, its New AI Assistant, Providing Mortgage Lending Execs with Realtime Business Insights

SAN DIEGO, Calif. /California Newswire / -- Optimal Blue today announced Ask Obi, an AI assistant designed to provide mortgage lending executives with instant, actionable insights from their Optimal Blue products and data. Unveiled during Optimal Blue's inaugural Summit user conference in San Diego, Ask Obi gives lenders the power to view their operations holistically with data aggregation across Optimal Blue's comprehensive capital markets platform.

Secured Signing Supports Cisco Duo Single Sign-On for Digital Signatures and Remote Online Notarization

MOUNTAIN VIEW, Calif. /California Newswire/ -- Secured Signing, a global leader in Digital Signatures and Remote Online Notarization (RON) solutions, has announced the integration of Cisco Duo Single Sign-On, a cutting-edge enhancement designed to fortify user login security. This milestone innovation introduces built-in two-factor authentication (2FA) to the platform, setting a new standard in safeguarding digital transactions.

The Mortgage Collaborative Has Appointed Jodi Hall as its New CEO

SAN DIEGO, Calif. /California Newswire / -- The Mortgage Collaborative (TMC), the nation's leading network of independent mortgage lenders, banks, credit unions, and service providers, is proud to announce the appointment of Jodi Hall as its new Chief Executive Officer and President.

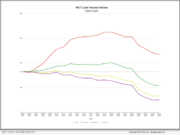

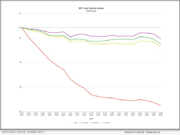

MCT Report Shows 16% Decrease in Mortgage Lock Volume Amid Market Dynamics

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 16.7% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report to gain comprehensive insights into the evolving market dynamics.

CapitalW Collective Aligns with Polly to Support Women in Mortgage Capital Markets

SAN DIEGO, Calif. /California Newswire -- CapitalW Collective, a trailblazing non-profit dedicated to advancing women and their allies in mortgage capital markets, proudly announces Polly as its first product and pricing engine (PPE) Diamond-level corporate sponsor. This alliance underscores CapitalW Collective's mission "to create more inclusive and dynamic mortgage capital markets, one woman and ally at a time."

Ryan Kaufman of Informative Research Named to 2024 National Mortgage Professional’s 40 Under 40 List

IRVINE, Calif. /CALIFORNIA NEWSWIRE/ -- Informative Research, a premier technology provider delivering data-driven credit and verification solutions to the lending community, announced that Ryan Kaufman, IT Manager of Integrations, has been named to the National Mortgage Professional (NMP) 40 Under 40 list. This honor recognizes exceptional professionals who are influencing the future of the mortgage industry.

MCT Reports 15% Decrease in Mortgage Lock Volume Amid Higher Rates in Nov.

SAN DIEGO, Calif. /CALIFORNIA NEWSWIRE/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, has announced a 15.12% decrease in mortgage lock volume compared to the previous month. The data, reflecting current market dynamics, is available in MCT's latest report, which offers in-depth analysis and insights for industry professionals and stakeholders.

Secured Signing books 30% month-over-month growth in demand for its Remote Online Notarizations Platform

MOUNTAIN VIEW, Calif. /CALIFORNIA NEWSWIRE/ -- Secured Signing, a leading provider of digital signing and Remote Online Notarization (RON) solutions, is excited to unveil a series of powerful enhancements to its platform. These updates solidify its leadership in the digital notarization industry by optimizing workflow efficiency, increasing transparency, and enhancing user control.

MCT Announces 2.5% Increase in Mortgage Lock Volume Despite October 2024 Market Volatility

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, reported a 2.5% increase in mortgage lock volume compared to the previous month. Mortgage market professionals and industry enthusiasts are invited to download MCT's comprehensive report to gain deeper insights into the current market dynamics.

Fintech Innovator, MCT, Empowers Mortgage Hedging Performance with Customized Spec Durations

SAN DIEGO, Calif. /CALIFORNIA NEWSWIRE/-- Mortgage Capital Trading, Inc. (MCT), the de facto leader in innovative mortgage capital markets technology, announced today an improvement to functionality through customizable duration analysis for specified loan products. Mortgage lenders using the comprehensive capital markets platform MCTlive! now have the ability to increase, review, and refine the granularity of their spec durations, leading to more precise hedging and reduced basis risk.

Informative Research Brings its Mortgage Verification Platform to the Dark Matter Exchange Network

GARDEN GROVE, Calif. /CALIFORNIA NEWSWIRE/ -- Informative Research, a premier technology provider delivering data-driven credit and verification solutions to the lending community, today announced it has made its Verification Platform solution available in the Dark Matter Technologies (Dark Matter) Exchange℠ service network to streamline verification of income (VOI) and verification of employment (VOE) for more lenders.

CapitalW Collective Announces Katten as Corp. Sponsor, Supporting Women in Mortgage Capital Markets

SAN DIEGO, Calif. /CALIFORNIA NEWSWIRE/ -- CapitalW Collective, the glass shattering 501(c)(3) benefiting women and their allies in mortgage capital markets, today announced Katten Muchin Rosenman LLP as a new corporate sponsor. This strategic collaboration marks a significant step forward in CapitalW Collective's mission "to create more inclusive mortgage capital markets, one woman and ally at a time."

Secured Signing Launches Integration with Okta for Enhanced Single Sign-On Experience (SSO)

MOUNTAIN VIEW, Calif. /CALIFORNIA NEWSWIRE/ -- Secured Signing is excited to announce its official integration with Okta, a leading identity management solution, to deliver seamless and secure Single Sign-On (SSO) capabilities. This integration enhances user experience and security for employees, contractors, and business partners, ensuring they have quick, reliable access to the tools they need to perform at their best.

MCT Expands MSR Valuation Options with AD&Co Prepayment Model: Precision and Confidence for MSR Managers

SAN DIEGO, Calif. /CALIFORNIA NEWSWIRE/ -- Mortgage Capital Trading, Inc. (MCT), the de facto leader in innovative mortgage capital markets technology, today announced the integration of the LoanDynamics Model (LDM) from Andrew Davidson & Co. (AD&Co) into their mortgage servicing rights (MSR) valuation software. LDM is a well-respected prepayment model for residential mortgages that will complement MCT's proprietary prepayment model in MSRlive!

MCT Reports 3% Increase in Mortgage Lock Volume, Refinance Activity Buoys Market in Q3/24

SAN DIEGO, Calif. /CALIFORNIA NEWSWIRE/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 3.17% increase in mortgage lock volume compared to the previous month. The report highlights key market dynamics, offering industry professionals valuable insights. Industry professionals and enthusiasts are invited to download the complete report for comprehensive insights into the market dynamics.

IRS Advance Notice by IRS Solutions Software Named as a 2024 Tax and Technology Innovation Award Finalist

VALENCIA, Calif. /CALIFORNIA NEWSWIRE/ -- IRS Solutions® announces that its cutting-edge feature, IRS Advance Notice™ (IAN), has been named a finalist for the CPA Practice Advisor 2024 Tax and Technology Innovation Award. The revolutionary new technology tracks and alerts their members to IRS transcript changes, streamlining tax resolution, improving client service, and offering steady, year-round income for tax professionals.

MCT Reports 3% Increase in Mortgage Lock Volume Backed by Increased Refinance Activity

SAN DIEGO, Calif., /CALIFORNIA NEWSWIRE/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 3.33% increase in mortgage lock volume compared to the previous month. Despite a larger increase in rate/term volume, total mortgage volume remains relatively flat.

Calif. Legislature Approves Landmark IVF Bill to Require Insurance Coverage for Fertility Healthcare, Sending Measure to Gov. Newsom

SACRAMENTO, Calif. /CALIFORNIA NEWSWIRE/ -- The California State Legislature approved Senate Bill 729, authored by State Senator Caroline Menjivar (D-San Fernando Valley) and sponsored by California State Insurance Commissioner Ricardo Lara, with bipartisan support today sending the measure to Governor Newsom's desk with votes of 55-0 in the Assembly and 30-8 in the Senate.

Secured Signing Notary Community enables notaries to connect with clients online, receive jobs, and chat directly

MOUNTAIN VIEW, Calif. /California Newswire/ -- Secured Signing, a frontrunner in the realm of digital signature and remote online notarization solutions, is thrilled to unveil a series of substantial upgrades to its Notary Community platform. These enhancements are meticulously crafted to empower notaries to broaden their client base, attract many business opportunities, and optimize their workflow efficiency.

Patented Fintech Allows Mortgage Buyers to Transact with Any Seller on MCT Marketplace

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced that the company has been awarded a patent for the security spread commitment used in the industry's largest mortgage asset exchange: MCT Marketplace. The security spread commitment transforms loan auctions, turning shadow bids into executable prices.

MCT Reports a 6% Mortgage Lock Volume Decrease in Latest July 2024 Report

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a decrease of 5.67% in mortgage lock volume compared to the previous month. Industry professionals and enthusiasts are invited to download the complete report for comprehensive insights into the market dynamics.

Informative Research’s Kelly Richards Receives 2024 MPA Elite Women Award

IRVINE, Calif. /California Newswire/ -- Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced today that Kelly Richards, Head of Sales Support, has been named a winner of the MPA Elite Women 2024 by Mortgage Professional America (MPA). This award recognizes exceptional female leaders who have significantly contributed to the mortgage industry.

Informative Research Enhances Verification Platform through Expanded Integration with The Work Number from Equifax

GARDEN GROVE, Calif. /California Newswire/ -- Informative Research, a leading technology platform delivering data-driven solutions to the lending community, today announced the expansion of its verification platform through the integration of additional Equifax solutions that leverage The Work Number®, the industry-leading commercial source of consolidated income and employment information.

Informative Research Adds Process Transformation Expert, Brandon Hall as New EVP of Operations

GARDEN GROVE, Calif. /California Newswire/ -- Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, has named Brandon Hall as its new executive vice president (EVP) of operations. Hall brings over 20 years of experience driving operational excellence within the financial services sector and is known for implementing innovative process improvements, fostering cross-functional collaboration and leading through change.

MCT Integrates with Fannie Mae’s Mission Score API and New Product Grids to Empower Originators to Take Advantage of Market Incentives

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced the launch of new integrations with Fannie Mae's Mission Score application programming interface (API) and Mission Score 2 and 3 product grids that provide better transparency and pricing for mortgages aligned with Fannie Mae's mission objectives.

Remote Online Notarization Innovator, Secured Signing, Scales Up with Strategic Leadership & Global Expansion

MOUNTAIN VIEW, Calif. /California Newswire/ -- Secured Signing, a leading provider of secure Digital Signatures and Remote Online Notarization platform, today announced a significant growth, fueled by a visionary leadership change and strategic team expansion.

MCT and Lender Price announce partnership to Improve Mortgage Pricing with Loan-Level MSR Values

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading (MCT®), the de facto leader in innovative mortgage capital markets technology, and Lender Price, the first cloud-native provider of mortgage pricing technology, have partnered to provide mortgage lenders using the Lender Price product and pricing engine (PPE) with loan-level MCT MSR values. MCT's industry-leading mortgage servicing rights (MSR) grids allow Lender Price PPE clients to be more granular, profitable, and efficient when generating their front-end borrower pricing and managing their MSR portfolio.

MCT Reports A 7% Mortgage Lock Volume Increase In Latest May 2024 Indices Report

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 6.78% in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

Newly Launched CapitalW Collective is Educating, Elevating, and Empowering Women in Mortgage

SAN DIEGO, Calif. /California Newswire/ -- CapitalW Collective (CapitalW), the glass shattering non-profit benefiting women and their allies in mortgage capital markets, today announced its successful debut within the mortgage industry. Officially launched on May 1, 2024, CapitalW made its first appearance at the Mortgage Bankers Association Secondary and Capital Markets Conference in New York May 19-21, 2024.

Remote notarization is streamlined with Secured Signing’s new features

MOUNTAIN VIEW, Calif. /California Newswire/ -- Secured Signing, a leader in remote online notarization (RON) solutions, announces a suite of innovative features designed to streamline the online document signing and notarization process. These enhancements empower both notaries and singers to experience a smoother, more secure, and efficient experience.

New Fintech Solution Connects API-Driven Back-End to Front-End Pricing with Industry-First Features

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of the Base Rate Generator, an industry-changing solution that allows mortgage lenders to directly inform their front-end rate sheet pricing with their back-end capital markets executions. By combining live agency API connections, co-issue executions, aggregator pricing, and custom TBA indications, the MCT Base Rate Generator allows mortgage lenders to improve margin management and competitive performance.

Mortgage Capital Trading, Inc. Reports A 2% Lock Volume Increase Despite Rising Rates

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today reported a 1.87% increase in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

Informative Research Adds Mortgage Finance Expert Kurt Raymond CMB as SVP

GARDEN GROVE, Calif. /California Newswire/ -- Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced it has expanded its team to add mortgage industry veteran Kurt Raymond, CMB as Senior Vice President and Borrower Journey Engineer. The move reflects Informative Research's commitment to helping lenders streamline origination costs and enhance the borrower experience.