Tag: Mortgage News - Page 7

DocMagic CEO Dominic Iannitti honored with 2022 Legends of Lending Award

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of fully-compliant loan document generation, regulatory compliance, and comprehensive eMortgage services, announced that its president and CEO, Dominic Iannitti, has been selected by Mortgage Banker magazine as a 2022 Legends of Lending award recipient.

Sales Boomerang’s New Life Event Alerts Help Lenders Grow Pipelines While Fostering Strong Financial Friendships

OWINGS MILLS, Md. and IRVINE, Calif., July 14, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced the launch of its newest automated alert offering, Life Event Alerts, which notify mortgage advisors when a borrower or a prospect in their customer database experiences a major life change that could alter their financial situation and/or goals.

Promontory MortgagePath’s Louann Bernstone Named to Elite Women’s List by Mortgage Professional America

DANBURY, Conn., July 13, 2022 (SEND2PRESS NEWSWIRE) -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced Louann Bernstone, managing director of vendor management, has been named to Mortgage Professional America's (MPA) sixth annual Elite Women list. This award recognizes successful women making waves and pushing boundaries in the traditionally male-dominated mortgage industry.

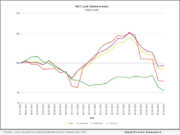

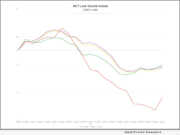

MCTlive! Lock Volume Indices: June 2022 Data – represents a balanced cross section of lenders among retail, correspondent, wholesale, and consumer...

SAN DIEGO, Calif. /California Newswire/ -- MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for June 2022.

OpenClose’s Mitch Swanson Honored by PROGRESS in Lending with Next Gen Leader Award

WEST PALM BEACH, Fla., July 8, 2022 (SEND2PRESS NEWSWIRE) -- OpenClose®, the leading fintech provider of residential mortgage software solutions for banks, credit unions and mortgage lenders, announced that its product delivery manager, Mitch Swanson, has been recognized as a Next Gen Leader within the industry by PROGRESS in Lending Association.

DocMagic COO, Gavin T. Ales, Receives 2022 Next Gen Leader Award

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of fully-compliant loan document generation, regulatory compliance, and comprehensive eMortgage services, announced that Gavin T. Ales, its chief compliance officer, has been named a Next Gen Leader for 2022 by PROGRESS in Lending.

Click n’ Close Promotes Daniel Forshey and Sady Mauldin to C-Suite

ADDISON, Texas, July 6, 2022 (SEND2PRESS NEWSWIRE) -- Click n' Close, a multi-state mortgage lender serving consumers and mortgage originators through its wholesale and correspondent channels, is pleased to announce the company has promoted Daniel Forshey to Chief Operating Officer and Sady Mauldin to Chief Compliance Officer.

FormFree announces support for new Freddie Mac Loan Product Advisor enhancement aimed at expanding sustainable homeownership for renters

ATHENS, Ga., June 30, 2022 (SEND2PRESS NEWSWIRE) -- FormFree® announced that mortgage lenders using AccountChek® verification of asset (VOA) reports in conjunction with a Freddie Mac Loan Product Advisor® (LPA℠) solution will soon benefit from an enhancement that takes loan applicants' 12-month on-time rent payment history into consideration when assessing eligibility for qualified first-time homebuyers.

iEmergent appoints Megan Horn as Chief Marketing Officer

DES MOINES, Iowa, June 30, 2022 (SEND2PRESS NEWSWIRE) -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the appointment of Megan Horn as chief marketing officer (CMO). In this role, Horn will oversee marketing, public relations, brand management and customer experience for the growing company.

Ruoff Mortgage Selects ACES Quality Management & Control to Improve Loan Quality Enterprise-wide Across Multiple Product Lines

DENVER, Colo., June 29, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that Ruoff Mortgage Company, Inc. (Ruoff Mortgage), a full-service residential mortgage lender, has selected its flagship audit platform ACES Quality Management & Control® Software to support the company's origination and servicing quality control (QC) audits.

Sales Boomerang and Mortgage Coach Merge, Appoint Richard Harris as CEO

OWINGS MILLS, Md., and IRVINE, Calif., June 28, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced their merger and the appointment of SaaS executive Richard Harris as CEO.

Lender Price Launches Marketplace 2.0: Enhanced Pricing Capabilities and Deal Intelligence

PASADENA, Calif. /California Newswire/ -- Lender Price, a leading provider of product, pricing and eligibility technology, announced today they have released Marketplace 2.0, a major enhancement to their Broker Marketplace platform, one of the largest communities of wholesale brokers in the mortgage industry.

Mid America Mortgage rebrands to Click n’ Close

ADDISON, Texas, June 27, 2022 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. (Mid America) today announced it has rebranded as Click n' Close following the sale of the majority of its retail lending operations to Houston-based Legend Lending. Click n' Close will retain retail operations related to its reverse mortgage and Native American lending business and focus on delivering innovative down payment assistance (DPA) and adjustable-rate mortgage (ARM) products through its third-party originator (TPO) channels.

DocMagic’s eClosing team member Leah Sommerville Recognized with 2022 Trailblazer Award

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of fully-compliant loan document generation, regulatory compliance, and comprehensive eMortgage services, announced that Leah Sommerville, a senior account executive on its eClosing team, has been honored by PROGRESS in Lending as a 2022 Sales & Marketing Trailblazer. The award recognizes sales, marketing and public relations executives that are blazing trails in the mortgage industry.

TMC Emerging Technology Fund LP Invests in leadPops, a digital customer acquisition software and marketing innovation platform

SAN DIEGO, Calif. /California Newswire/ -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") recently participated in a follow-on round to a recent $3.5M Series A completed by leadPops, a digital customer acquisition software and marketing innovation platform. leadPops allows users to create robust, automated lead-generating systems that drive qualified leads directly to their business.

Mid America Mortgage Now Offers eNotes to Non-Delegated Correspondents through its Wholesale Channel

ADDISON, Texas, June 21, 2022 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. (Mid America) announced today it is offering eNotes capabilities via its wholesale channel to enable non-delegated correspondents to operate more efficiently and competitively as they make the transition from mortgage broker to banker. Through this program, third-party originators (TPOs) can deliver the convenience digital closings provide to their customers and enhance relationships with their existing real estate and title partners amidst an otherwise challenging operating environment.

New MSR Technology from MCT Empowers MSR Buyers with Live Loan-Level Pricing

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, has announced today a new technology for mortgage servicing rights (MSR) buyers to produce more granular pricing for mortgage servicing. The feature leverages an application programming interface (API) to connect MSRlive!, MCT's state-of-the-art MSR valuation platform to clients' systems for more precise and accurate loan-level pricing in real time.

Q4 2021 Critical Defect Rate Rose to 1.95%, Per ACES Quality Management Mortgage QC Industry Trends Report

DENVER, Colo., June 16, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) and full calendar year (CY) of 2021. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

OpenClose Adds DataVerify Solutions to its LenderAssist™ LOS

WEST PALM BEACH, Fla., June 14, 2022 (SEND2PRESS NEWSWIRE) -- OpenClose®, a leading fintech provider of mortgage software solutions for banks, credit unions and mortgage lenders, announced that it has integrated its LenderAssist™ loan origination system (LOS) with the DataVerify® DRIVE® platform to seamlessly validate borrower provided data.

Mortgage Markets CUSO selects Mortgage Coach to increase mortgage lending engagement at credit unions

IRVINE, Calif. /California Newswire/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced today that Mortgage Markets CUSO, LLC has implemented Mortgage Coach to grow mortgage lending engagement at the credit unions it serves.

ACES Quality Management Unveils Certified ACES Administrator Program at Inaugural ACES ENGAGE Event in Colorado Springs

DENVER, Colo., June 7, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the launch of its Certified ACES Administrator (CAA) program during its inaugural ACES ENGAGE event, held May 23-25, 2022 at the Broadmoor Hotel in Colorado Springs.

Down Payment Resource analysis finds that 33% of declined mortgage applications are declined for reasons addressable with homebuyer assistance

ATLANTA, Ga., June 7, 2022 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from an analysis showing that a substantial share of mortgage loan applications are both declined for reasons that can be addressed with homebuyer assistance and eligible for homebuyer assistance programs.

Housing Finance Strategies Hires Stuart Quinn as Managing Director

WASHINGTON, D.C., June 7, 2022 (SEND2PRESS NEWSWIRE) -- Housing Finance Strategies Founder & CEO Faith Schwartz today announced she has recruited mortgage consulting and product manager Stuart Quinn to join her firm as Managing Director.

MCT, the leader in capital markets software, announces MCTlive! Lock Volume Indices May 2022 Data

SAN DIEGO, Calif. /California Newswire/ -- MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for May 2022.

iEmergent appoints Chris Richey as Chief Analytics Officer

DES MOINES, Iowa, June 2, 2022 (SEND2PRESS NEWSWIRE) -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the appointment of Chris Richey as chief analytics officer. In this role, Richey will oversee and expand upon iEmergent's data analytics capabilities, which help mortgage lenders identify gaps in sales coverage and effectively expand into new markets.

Mortgage lenders are now able to use FormFree AccountChek to satisfy Freddie Mac’s reverification of employment requirement

ATHENS, Ga., June 1, 2022 (SEND2PRESS NEWSWIRE) -- FormFree® today announced that its AccountChek® digital asset verification service supports a new enhancement to Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM) solution that makes assessment of borrower employment easier, faster, less expensive and more fraud-resistant.

Cheryl Messner joins Sales Boomerang to oversee customer experience department

WASHINGTON, D.C., June 1, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced that it has tapped Cheryl Messner to manage its customer experience departments. In her new role, Messner will define strategies to enhance Sales Boomerang's customer experience, engagement, success and operations as well as help the company build upon its growth from a fintech startup to the industry's leading borrower intelligence solution.

MMI earns a spot on the 2022 Inc. 5000 Regionals List

SALT LAKE CITY, Utah, May 26, 2022 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it has ranked No. 29 on Inc. Magazine's third annual Inc. 5000 Regionals: Rocky Mountains list.

MISMO Certifies the DocMagic Total eClose Platform and Proprietary RON Technology

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of compliant loan document generation, automated regulatory compliance and comprehensive eMortgage services, announced that it attained MISMO's eClosing System and remote online notarization (RON) certifications for its Total eClose™ solution.

PROGRESS in Lending Names DocMagic Director of Client Services to 2022 Most Powerful Women in Fintech List

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of fully-compliant loan document generation, regulatory compliance, and comprehensive eMortgage services, announced that its director of client services, Lori Johnson, has been recognized by PROGRESS in Lending Association as a leading female technology professional in the mortgage industry.

Black Knight Inc.’s Empower Loan Origination Platform Now Integrated with DocMagic

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of loan document generation, compliance support and comprehensive eMortgage services, announced an integration with Empower, Black Knight's loan origination system (LOS), to help automate the DocMagic document generation process for lenders and provide access to additional DocMagic services.

PROGRESS in Lending Lauds Kathy Olsen of OpenClose with Most Powerful Women in Fintech Award

WEST PALM BEACH, Fla., May 17, 2022 (SEND2PRESS NEWSWIRE) -- OpenClose®, the leading fintech provider of residential mortgage software solutions for banks, credit unions and mortgage lenders, announced that its director of support services, Kathy Olsen, has been honored by PROGRESS in Lending Association as a leading female technology professional in the mortgage industry.

OneKey MLS names Down Payment Resource partners as designated provider of down payment assistance tools

ATLANTA, Ga. and WEST BABYLON, N.Y., May 17, 2022 (SEND2PRESS NEWSWIRE) -- OneKey® MLS, the largest multiple listing service (MLS) in New York, today announced that it has partnered with Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, to indicate MLS residential listings that may be eligible for down payment assistance and other homebuyer affordability programs.

Agile Launches Agile Chat for Lenders and Broker Dealers

PHILADELPHIA, Pa., May 11, 2022 (SEND2PRESS NEWSWIRE) -- Agile, a groundbreaking fintech bringing mortgage lenders and broker dealers onto a single electronic platform, today announced the launch of Agile Chat, a new chat feature designed to increase transparency and efficiency between lenders and broker dealers.

Gary D. McKiddy Assumes Chief Financial Officer Role at Mid America Mortgage

ADDISON, Texas, May 11, 2022 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. (Mid America) announced today that Gary D. McKiddy has been promoted from Chief Risk Officer to Chief Financial Officer. In this new role, McKiddy will manage financial operations and strategy as Mid America Mortgage continues to refine its operations and drive business growth through recent product line additions, such as its correspondent down payment assistance (DPA) program.

Mortgage Coach names Suzanne Duniphin to VP, Customer Experience and David Bowser to VP, Customer Engagement

IRVINE, Calif. /California Newswire/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced the advancement of two of its department directors to vice president-level positions. Suzanne Duniphin was promoted from director of eLearning to VP, customer experience, and David Bowser was promoted from director of account management to VP, customer engagement.

realMLS enhances listing service with Down Payment Resource to help subscribers connect consumers with homebuyer assistance programs

ATLANTA, Ga. and JACKSONVILLE, Fla., May 10, 2022 (SEND2PRESS NEWSRIE) -- realMLS, serving 11,000 members in Northeast Florida, today announced that it has partnered with Down Payment Resource (DPR) to enhance its platform with DPR's suite of real estate agent tools that help MLS customers connect homebuyers with homebuyer assistance programs.

FormFree opens registration to its third annual Heroes Golf Classic 2022 benefiting the American Red Cross of Northeast Georgia

ATHENS, Ga., May 10, 2022 (SEND2PRESS NEWSWIRE) -- FormFree today announced it has opened registration to the organization's third annual Heroes Golf Classic, which will be held on September 9, 2022, at Lanier Islands Legacy Golf Course in Buford, Georgia. All proceeds from the event will be donated to the American Red Cross of Northeast Georgia, a 501(c)(3) nonprofit organization that provides emergency assistance and preparedness education to communities affected by disaster.

New MCTlive! Mortgage Lock Volume Indices to help all industry participants better understand key trends in the mortgage industry

SAN DIEGO, Calif. /California Newswire/ -- MCT®, the leading pipeline hedge advisory in the residential mortgage industry, is pleased to announce the introduction of new MCTlive! Mortgage Lock Volume Indices to help all industry participants better understand key trends in the mortgage industry.

MMI appoints Kortney Lane-Schafers as Regional Director of Growth

SALT LAKE CITY, Utah, May 9, 2022 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it has hired Kortney Lane-Schafers as a regional director of growth. Lane-Schafers' responsibilities will include consulting and strategizing with MMI's growing roster of mortgage enterprise clients.

Centier Bank Leverages DocMagic eVault Fintech to Accept and Manage eNotes

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of compliant loan document generation, automated regulatory compliance and comprehensive eMortgage services, announced that Indiana-based Centier Bank is now equipped to receive eNotes from their warehouse clients through DocMagic's eVault solution. The move positions Centier to secure more business as mortgage bankers increasingly adopt eClosing technology.

Housing Finance Strategies Names Allen Jones Chief Administrative Officer

WASHINGTON, D.C., May 6, 2022 (SEND2PRESS NEWSWIRE) -- Housing Finance Strategies President Faith Schwartz today announced that she has named industry veteran and former Big 4 consulting executive Allen Jones as Chief Administrative Officer and Managing Director of the Consulting Practice.

EY announces Mark Cunningham and Alex Kutsishin of Sales Boomerang as Entrepreneur Of The Year® 2022 Mid-Atlantic Award finalists

BALTIMORE, Md., May 4, 2022 (SEND2PRESS NEWSWIRE) -- Ernst & Young LLP (EY US) today announced that Sales Boomerang co-founders Mark Cunningham, president, and Alex Kutsishin, CEO, were named finalists for the Entrepreneur Of The Year® 2022 Mid-Atlantic Award. Entrepreneur Of The Year is one of the preeminent competitive business awards for entrepreneurs and leaders of high-growth companies who think big to succeed.

Down Payment Resource teams up with Realtor.com to Help Home Shoppers Find Homebuyer Assistance Programs

ATLANTA, Ga., May 3, 2022 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced that Realtor.com® has deployed DPR's search tool that helps home shoppers find homebuyer assistance programs.

Logix Federal Credit Union selects Mortgage Coach to enhance its mortgage advisory service

IRVINE, Calif. /California Newswire/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced today that Logix Federal Credit Union (Logix) has rolled out Mortgage Coach to enhance the mortgage advisory service it provides to members.

HW Tech100 Mortgage 2022 Award Honors MCT As Leader In Innovation

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, was announced as a 2022 HousingWire Tech100 Mortgage Winner. The Tech100 Mortgage Award spotlights innovators that are making the housing sector better and more sustainable by increasing efficiency, improving borrower experience and bringing elasticity to mortgage origination and servicing processes.

MMI adds mortgage industry vets Jake Belter and Gerald Dorman to enterprise sales team as regional directors

SALT LAKE CITY, Utah, April 26, 2022 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it has hired mortgage industry veterans Jake Belter, CMB(r), and Gerald Dorman to its enterprise sales team. As regional directors, Belter and Dorman will be tasked with expanding MMI's growing roster of mortgage enterprise clients.

Mortgage Hedge Advisory Firm Vice Capital Markets promotes Shawn Ansley to CIO

NOVI, Mich., April 21, 2022 (SEND2PRESS NEWSWIRE) -- Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today that it has promoted Shawn Ansley to chief information officer (CIO). As CIO, Ansley will be tasked with the continued development of information technologies and deepening integrations with the agencies and major loan origination systems.

Down Payment Resource releases Q1 2022 Homeownership Program Index

ATLANTA, Ga., April 19, 2022 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced the release of its latest Homeownership Program Index (HPI). The firm's analysis of 2,238 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 46 from Q4 2021 to Q1 2022.

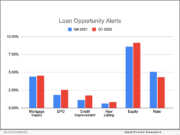

Sales Boomerang releases Q1 2022 Mortgage Market Opportunities Report

WASHINGTON, D.C., April 18, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. The Q1 2022 report showed an increase in purchase and home-equity loan opportunities that could help lenders offset dwindling refi volume.