Tag: Mortgage

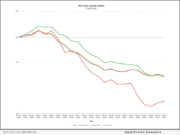

MCT releases MCTlive! Lock Volume Indices for August 2022

SAN DIEGO, Calif. /California Newswire/ -- MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for August 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

Financial Center First Credit Union Selects ACES Quality Management & Control to Improve Consumer Loan Quality

DENVER, Colo., Sept. 7, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that Financial Center First Credit Union (FCFCU) has selected ACES' flagship audit platform ACES Quality Management & Control® Software to support quality control (QC) audits for FCFCU's consumer lending channels.

MMI announces its newest Regional Director of Growth, Heidi Iverson

SALT LAKE CITY, Utah, Sept. 7, 2022 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced that Heidi Iverson has joined the organization as a regional director of growth. In this position, Iverson will consult and strategize with MMI's clientele which now includes more than 40 of the top 50 lenders in the nation, to identify growth opportunities to drive adoption and increase return on investment (ROI).

INC. 5000 Ranks Mortgage Capital Trading, Inc. (MCT®) On Its 2022 Fastest Growing Private Companies List For 11th Time

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that Inc. 5000 named MCT to its 2022 list of winners for the nation's fastest-growing private companies. MCT ranked number 4713 with three-year sales growth of 90% percent. This is the second year in a row that MCT made Inc. 5000's list and the company's 11th year making the list since its inception.

TMC Emerging Technology Fund LP invests in Willow Servicing, participates in a $6 million seed round

SAN DIEGO, Calif. /California Newswire/ -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") recently participated in a $6 million seed round for Willow Servicing. The round was led by Thomvest Ventures, with participation from Global Asset Capital, Webb Investment Network and Zigg Capital.

FormFree integrates with Docutech to streamline loan production with VOA and VOI/E capture

ATHENS, Ga., Aug. 29, 2022 (SEND2PRESS NEWSWIRE) -- FormFree® today announced the integration of AccountChek®, a service that allows lenders to verify borrowers' assets, income, employment and rent payment history, with Solex®, a comprehensive eDelivery, eSign, eClose and eVault platform from Docutech®, a First American company.

MMI ranks No. 11 on Utah Fast 50 list of fastest-growing companies

SALT LAKE CITY, Utah, Aug. 26, 2022 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it ranks No. 11 on the 2022 Utah Business list of fastest growing companies in the state.

For 2022, DocMagic Earns a Second Consecutive Spot on the Inc. 5000 List of Fastest-Growing Private Companies

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of fully-compliant loan document generation, regulatory compliance, and comprehensive eMortgage services, announced that it again made Inc. 5000's list of fastest-growing private companies for 2022.

FormFree and Finastra partnership streamlines borrower verification for improved mortgage loan processing

ATHENS, Ga. and LONDON, U.K., Aug. 22, 2022 (SEND2PRESS NEWSWIRE) -- Finastra and FormFree®, a market-leading fintech company that enables lenders to understand people's true ability to pay (ATP®), have partnered to further streamline electronic borrower verification for mortgage lenders.

MCTlive! Platform Becomes First to Integrate with Freddie Mac Cash Settlement Purchase Statement API

SAN DIEGO, Calif. /California Newswire/ -- MCT's award-winning capital markets platform, MCTlive!, is the first to integrate with Freddie Mac’s Cash Settlement Purchase Statement API. This API connection allows MCT Mark-to-Market and Hedge Accounting Reports to be updated with Freddie Mac purchase data directly, instead of waiting to run reports through a Loan Origination System (LOS).

Vice Capital Markets Releases API for Freddie Mac Cash Purchase Statement

NOVI, Mich., Aug. 18, 2022 (SEND2PRESS NEWSWIRE) -- Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today that it is one of the first Freddie Mac-integrated Secondary Market Advisors (SMAs) to release an integration for Freddie Mac's Cash Settlement Purchase Statement application programming interface (API).

Sales Boomerang named to Inc. 5000 list for second consecutive year

OWINGS MILLS, Md. and IRVINE, Calif., Aug. 16, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced that the Sales Boomerang borrower intelligence solution made its second consecutive appearance on Inc.'s annual Inc. 5000 list.

Promontory MortgagePath adds John Gust as Director of Product Management

DANBURY, Conn., Aug. 16, 2022 (SEND2PRESS NEWSWIRE) -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced industry veteran John Gust has joined the organization as the director of product management. In this role, Gust leads the product management and user experience teams and is responsible for product strategy, planning, execution, and rollout of Promontory MortgagePath's mortgage fulfillment services and end-to-end technology solution.

How A Mortgage Focused Agency Launched to Make Impact

INDIANAPOLIS, Ind., Aug. 16, 2022 (SEND2PRESS NEWSWIRE) -- In the heart of Indianapolis, Indiana is a marketing agency focused on helping mortgage lenders and technology overcome obstacles, develop marketing strategies, and grow their business. That agency is Art Vs. Math. In 2019, Steven Cooley started Art Vs. Math to help improve marketing in the mortgage industry.

MMI debuts in top 1500 on the 2022 Inc. 5000 Annual List

SALT LAKE CITY, Utah, Aug. 16, 2022 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it ranks No. 1499 on the 2022 Inc. 5000 list of the fastest-growing private companies in America. The list represents a one-of-a-kind look at the most successful companies within the economy's most dynamic segment-its independent businesses.

Natalie Arshakian named a 2022 Mortgage Star by Mortgage Women Magazine

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced today that National Mortgage Professional's Mortgage Women Magazine selected Natalie Arshakian, Senior Director and Head of Lock Desk Operations at MCT, to its annual 2022 Mortgage Star Awards.

ACES Quality Management Executives selected to speak at Mortgage Bankers Association’s 2022 RMQA Conference

DENVER, Colo., Aug. 11, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced Executive Vice President of Compliance Amanda Phillips and Executive Vice President of Operations Sharon Reichhardt have been selected to speak at the upcoming Mortgage Bankers Association's (MBA) Risk Management, Quality Assurance and Fraud Prevention Forum (RMQA) taking place September 11-13 in Nashville, Tenn.

MPA Magazine Names MCT’s Natalie Arshakian to List of Elite Women For 2022

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced today that Natalie Arshakian has been selected to Mortgage Professional America (MPA) magazine's list of Elite Women in Mortgage for 2022. The annual awards, now in their sixth year, celebrate 67 successful women who are taking on gender inequality in leadership by continuously challenging societal expectations.

MCT Releases MCTlive! Lock Volume Indices for July 2022, Covering Mortgage Lender Activity

SAN DIEGO, Calif. /California Newswire/ -- MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for July 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

Mortgage Banker Magazine Names Curtis Richins of MCT on 2022 Legends of Lending List

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that Curtis Richins, President of MCT, has been selected to Mortgage Banker Magazine's inaugural "Legends of Lending" list. The magazine's inaugural class was compiled to highlight the most talented, ambitious, and legendary individuals who are achieving excellence and making a difference in the mortgage industry.

ACES Quality Management Updates Reporting Library to Incorporate Recent Guidance by Fannie Mae

DENVER, Colo., July 27, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that it has enhanced its reporting library within its flagship audit platform ACES Quality Management & Control® Software to help align with recent mortgage quality control (QC) reporting recommendations issued by Fannie Mae.

Sales Boomerang named Organization of the Year in the 2022 Sales and Marketing Technology Awards

OWINGS MILLS, Md., and IRVINE, Calif., July 26, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced that it was selected Organization of the Year in the Business Intelligence Group's 2022 Sales and Marketing Technology Awards program, also known as The Sammys.

Keller Mortgage deploys Mortgage Coach enterprise-wide to support borrowers with modern mortgage advice and education

OWINGS MILLS, Md., and IRVINE, Calif., July 26, 2022 (SEND2PRESS NEWSWIRE) -- Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced today that Keller Mortgage has made Mortgage Coach available to loan officers enterprise-wide.

National Mortgage Professional (NMP) Selects DocMagic Chief eServices Executive Brian D. Pannell for 2022 Most Connected Mortgage Professionals Award

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of fully-compliant loan document generation, regulatory compliance, and comprehensive eMortgage services, announced that Brian D. Pannell, the company's chief eServices executive, has been recognized by National Mortgage Professional (NMP) magazine as one of the most connected mortgage professionals within the industry for 2022.

National Mortgage Professional names Dave Savage to list of Most Connected Mortgage Professionals

OWINGS MILLS, Md., and IRVINE, Calif., July 22, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced that Chief Innovation Officer Dave Savage was named to National Mortgage Professional's (NMP) 2022 list of Most Connected Mortgage Professionals.

Sales Boomerang Q2 2022 Mortgage Market Opportunities Report

OWINGS MILLS, Md., and IRVINE, Calif., July 20, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. Sharp quarter-over-quarter increases in equity, credit-improvement and new-listing alerts in Q2 2022 point to areas of opportunity for lenders in a contracting mortgage market

Mortgage eClosing solutions innovator, NotaryCam, announces eClose360® product updates

NEWPORT BEACH, Calif. /California Newswire/ -- NotaryCam, the pioneering leader in online notarization and original provider of mortgage eClosing solutions, announced today that it has made updates to its eClose360 platform to expand its capabilities and deliver a better user experience for both notaries and document signers.

Down Payment Resource releases Q2 2022 Homeownership Program Index

ATLANTA, Ga., July 19, 2022 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from its latest Homeownership Program Index (HPI). The firm's analysis of 2,273 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 1.6% from Q1 to Q2 2022.

Sales Boomerang’s New Life Event Alerts Help Lenders Grow Pipelines While Fostering Strong Financial Friendships

OWINGS MILLS, Md. and IRVINE, Calif., July 14, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced the launch of its newest automated alert offering, Life Event Alerts, which notify mortgage advisors when a borrower or a prospect in their customer database experiences a major life change that could alter their financial situation and/or goals.

Promontory MortgagePath’s Louann Bernstone Named to Elite Women’s List by Mortgage Professional America

DANBURY, Conn., July 13, 2022 (SEND2PRESS NEWSWIRE) -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced Louann Bernstone, managing director of vendor management, has been named to Mortgage Professional America's (MPA) sixth annual Elite Women list. This award recognizes successful women making waves and pushing boundaries in the traditionally male-dominated mortgage industry.

MCTlive! Lock Volume Indices: June 2022 Data – represents a balanced cross section of lenders among retail, correspondent, wholesale, and consumer...

SAN DIEGO, Calif. /California Newswire/ -- MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for June 2022.

OpenClose’s Mitch Swanson Honored by PROGRESS in Lending with Next Gen Leader Award

WEST PALM BEACH, Fla., July 8, 2022 (SEND2PRESS NEWSWIRE) -- OpenClose®, the leading fintech provider of residential mortgage software solutions for banks, credit unions and mortgage lenders, announced that its product delivery manager, Mitch Swanson, has been recognized as a Next Gen Leader within the industry by PROGRESS in Lending Association.

Click n’ Close Promotes Daniel Forshey and Sady Mauldin to C-Suite

ADDISON, Texas, July 6, 2022 (SEND2PRESS NEWSWIRE) -- Click n' Close, a multi-state mortgage lender serving consumers and mortgage originators through its wholesale and correspondent channels, is pleased to announce the company has promoted Daniel Forshey to Chief Operating Officer and Sady Mauldin to Chief Compliance Officer.

FormFree announces support for new Freddie Mac Loan Product Advisor enhancement aimed at expanding sustainable homeownership for renters

ATHENS, Ga., June 30, 2022 (SEND2PRESS NEWSWIRE) -- FormFree® announced that mortgage lenders using AccountChek® verification of asset (VOA) reports in conjunction with a Freddie Mac Loan Product Advisor® (LPA℠) solution will soon benefit from an enhancement that takes loan applicants' 12-month on-time rent payment history into consideration when assessing eligibility for qualified first-time homebuyers.

iEmergent appoints Megan Horn as Chief Marketing Officer

DES MOINES, Iowa, June 30, 2022 (SEND2PRESS NEWSWIRE) -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the appointment of Megan Horn as chief marketing officer (CMO). In this role, Horn will oversee marketing, public relations, brand management and customer experience for the growing company.

Ruoff Mortgage Selects ACES Quality Management & Control to Improve Loan Quality Enterprise-wide Across Multiple Product Lines

DENVER, Colo., June 29, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that Ruoff Mortgage Company, Inc. (Ruoff Mortgage), a full-service residential mortgage lender, has selected its flagship audit platform ACES Quality Management & Control® Software to support the company's origination and servicing quality control (QC) audits.

Sales Boomerang and Mortgage Coach Merge, Appoint Richard Harris as CEO

OWINGS MILLS, Md., and IRVINE, Calif., June 28, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced their merger and the appointment of SaaS executive Richard Harris as CEO.

Lender Price Launches Marketplace 2.0: Enhanced Pricing Capabilities and Deal Intelligence

PASADENA, Calif. /California Newswire/ -- Lender Price, a leading provider of product, pricing and eligibility technology, announced today they have released Marketplace 2.0, a major enhancement to their Broker Marketplace platform, one of the largest communities of wholesale brokers in the mortgage industry.

DocMagic’s eClosing team member Leah Sommerville Recognized with 2022 Trailblazer Award

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of fully-compliant loan document generation, regulatory compliance, and comprehensive eMortgage services, announced that Leah Sommerville, a senior account executive on its eClosing team, has been honored by PROGRESS in Lending as a 2022 Sales & Marketing Trailblazer. The award recognizes sales, marketing and public relations executives that are blazing trails in the mortgage industry.

TMC Emerging Technology Fund LP Invests in leadPops, a digital customer acquisition software and marketing innovation platform

SAN DIEGO, Calif. /California Newswire/ -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") recently participated in a follow-on round to a recent $3.5M Series A completed by leadPops, a digital customer acquisition software and marketing innovation platform. leadPops allows users to create robust, automated lead-generating systems that drive qualified leads directly to their business.

New MSR Technology from MCT Empowers MSR Buyers with Live Loan-Level Pricing

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, has announced today a new technology for mortgage servicing rights (MSR) buyers to produce more granular pricing for mortgage servicing. The feature leverages an application programming interface (API) to connect MSRlive!, MCT's state-of-the-art MSR valuation platform to clients' systems for more precise and accurate loan-level pricing in real time.

Q4 2021 Critical Defect Rate Rose to 1.95%, Per ACES Quality Management Mortgage QC Industry Trends Report

DENVER, Colo., June 16, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) and full calendar year (CY) of 2021. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

OpenClose Adds DataVerify Solutions to its LenderAssist™ LOS

WEST PALM BEACH, Fla., June 14, 2022 (SEND2PRESS NEWSWIRE) -- OpenClose®, a leading fintech provider of mortgage software solutions for banks, credit unions and mortgage lenders, announced that it has integrated its LenderAssist™ loan origination system (LOS) with the DataVerify® DRIVE® platform to seamlessly validate borrower provided data.

Mortgage Markets CUSO selects Mortgage Coach to increase mortgage lending engagement at credit unions

IRVINE, Calif. /California Newswire/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced today that Mortgage Markets CUSO, LLC has implemented Mortgage Coach to grow mortgage lending engagement at the credit unions it serves.

ACES Quality Management Unveils Certified ACES Administrator Program at Inaugural ACES ENGAGE Event in Colorado Springs

DENVER, Colo., June 7, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the launch of its Certified ACES Administrator (CAA) program during its inaugural ACES ENGAGE event, held May 23-25, 2022 at the Broadmoor Hotel in Colorado Springs.

Down Payment Resource analysis finds that 33% of declined mortgage applications are declined for reasons addressable with homebuyer assistance

ATLANTA, Ga., June 7, 2022 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from an analysis showing that a substantial share of mortgage loan applications are both declined for reasons that can be addressed with homebuyer assistance and eligible for homebuyer assistance programs.

Housing Finance Strategies Hires Stuart Quinn as Managing Director

WASHINGTON, D.C., June 7, 2022 (SEND2PRESS NEWSWIRE) -- Housing Finance Strategies Founder & CEO Faith Schwartz today announced she has recruited mortgage consulting and product manager Stuart Quinn to join her firm as Managing Director.

MCT, the leader in capital markets software, announces MCTlive! Lock Volume Indices May 2022 Data

SAN DIEGO, Calif. /California Newswire/ -- MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for May 2022.

iEmergent appoints Chris Richey as Chief Analytics Officer

DES MOINES, Iowa, June 2, 2022 (SEND2PRESS NEWSWIRE) -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the appointment of Chris Richey as chief analytics officer. In this role, Richey will oversee and expand upon iEmergent's data analytics capabilities, which help mortgage lenders identify gaps in sales coverage and effectively expand into new markets.

Mortgage lenders are now able to use FormFree AccountChek to satisfy Freddie Mac’s reverification of employment requirement

ATHENS, Ga., June 1, 2022 (SEND2PRESS NEWSWIRE) -- FormFree® today announced that its AccountChek® digital asset verification service supports a new enhancement to Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM) solution that makes assessment of borrower employment easier, faster, less expensive and more fraud-resistant.