Tag: Taxes and Accounting

Free Book Available July 11 – 13 on Amazon/Kindle on How to Get Rid of the Income Tax and Abolish the...

SEATTLE, Wash. /California Newswire - National News/ -- How would you like to take home 100% of your paycheck and never pay income tax again? To learn more, get a free copy of the new book by Rich Germaine, "Tax Revolution 2.0, Let's Get Rid of the Income Tax."

New Book Explores Public Support for the Replacement of the Current Income Tax System | National News

SEATTLE, Wash. /California Newswire - National News/ -- It's been 250 years since the first tax revolution. Media Arts Institute, a Seattle-based media company, has just released a new book, "Tax Revolution 2.0, Let's Get Rid of the Income Tax" (ISBN: 979-8288643385; paper) by media consultant and researcher Rich Germaine.

IRS Solutions Announces New Discrepancy Report Feature: Helps Tax, Financial, and Legal Pros

VALENCIA, Calif. /California Newswire/ -- IRS Solutions®, the trusted name in tax resolution software, announces the launch of its latest innovation, the Discrepancy Report. This cutting-edge feature is designed to simplify the detection of discrepancies between filed tax returns and income data reported to the IRS by third parties. This will empower tax professionals to prevent audits while delivering exceptional service to their clients proactively.

MileageWise is the First to Offer Lifetime Deals for Mileage Tracking Solutions in the U.S. | National News

SARASOTA, Fla. /California Newswire - National News/ -- MileageWise is the first company to announce offering lifetime plans for mileage tracking, catering to long-term users. By eliminating monthly or yearly fees, users can significantly reduce software costs over time. Mileage tracker apps have become indispensable for ensuring tax compliance, minimizing audit risks, and maximizing deductions.

Info-Tech Research Group Names EnergyCAP a Leader for 2025 Data Quadrant Report | National News

STATE COLLEGE, Pa. /California Newswire - National News/ -- Global research and advisory firm, Info-Tech Research Group, has identified EnergyCAP as the #1 overall Champion in its 2025 Data Quadrant Report. The report findings are based on data from user reviews on the firm's SoftwareReviews platform, the leading source for insights on the software provider landscape. EnergyCAP is a leading provider of utility bill management and energy tracking software designed to help organizations reduce energy consumption and costs.

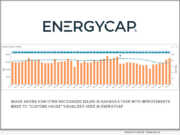

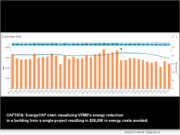

AFL Global Automates Energy Management and Anticipates $304K of Savings in First Year with EnergyCAP | National News

BOALSBURG, Pa. /California Newswire - National News/ -- AFL Global, a global leader in telecommunications and fiber optic solutions, has achieved a significant sustainability milestone by leveraging EnergyCAP, a leading energy and sustainability software platform. By implementing EnergyCAP, AFL Global has automated the management of nearly two-hundred utility accounts, which has enabled $304,000 in anticipated annual energy and utility cost savings and substantial environmental gains.

EnergyCAP Appoints Shawn Lankton as Chief Executive Officer | National News

BOALSBURG, Pa., Aug. 6, 2024 (SEND2PRESS NEWSWIRE) -- EnergyCAP, the leading provider of energy and sustainability enterprise resource planning (ERP) software, today announced the appointment of Shawn Lankton as Chief Executive Officer. This decision reflects the Board's continued and growing optimism across the spectrum of growth opportunities ahead for EnergyCAP.

Asset Defense Team and Vast Solutions Group Announce a New Joint Venture for Asset Protection and Tax Strategy | National News

SEATTLE, Wash., July 15, 2024 (SEND2PRESS NEWSWIRE) -- Asset Defense Team and Vast Solutions Group (VastSolutionsGroup.com) are pleased to announce their joint venture, VastAssetDefense.com. This partnership brings together two leading companies in the asset protection and tax strategy industry, combining their expertise and resources to provide top-quality services to clients around the globe. The alliance is introducing an advanced AI platform called "Einstein" and is currently in Beta 4.0 and is also introducing a community called Vast Vault.

EnergyCAP Named Market Leader in the Summer 2024 Energy Management Software Customer Success Report | National News

STATE COLLEGE, Pa., June 27, 2024 (SEND2PRESS NEWSWIRE) -- EnergyCAP has been named a Market Leader in the Energy Management Software category for the Summer 2024 Customer Success Report published by FeaturedCustomers. FeaturedCustomers is the leading customer success content marketing platform for B2B business software & services helping potential B2B buyers make informed purchasing decisions through vendor validated customer success content.

Garden Studios Bills Tenants and Identifies Energy Waste with EnergyCAP | National News

STATE COLLEGE, Pa., June 10, 2024 (SEND2PRESS NEWSWIRE) -- Garden Studios, an innovative film studio based in London, has transformed its utility management and billing processes by implementing EnergyCAP's leading energy management platform. This move aligns with Garden Studio's commitment to sustainability as a certified B Corporation, dedicated to responsible business practices.

EnergyCAP Eco Champion Award Winners Announced | National News

STATE COLLEGE, Pa., May 2, 2024 (SEND2PRESS NEWSWIRE) -- In the inaugural EnergyCAP Eco Champion Awards, leaders in sustainability and energy efficiency were celebrated across a diverse range of industries and use cases. All awards are based on submissions from the 2023 calendar year. EnergyCAP is a leading provider of energy and sustainability enterprise resource planning (ERP) solutions.

EnergyCAP earns 2024 Environment+Energy Leader Top Product Award | National News

STATE COLLEGE, Pa., April 22, 2024 (SEND2PRESS NEWSWIRE) -- EnergyCAP proudly announces that it has been awarded a coveted Top Product of the Year Award in the Environment+Energy Leader Awards program. This year marks a milestone as the program divides accolades into six innovative categories, tailoring recognition to specific sustainability and energy management excellence sectors. EnergyCAP's suite of solutions, UtilityManagement™, CarbonHub™, and SmartAnalytics™, together earned a top spot in the Software & Cloud category.

Informative Research Announces Manual VOI Integration with Veri-Tax

GARDEN GROVE, Calif. /California Newswire/ -- Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced the integration of Veri-Tax, the market leader in delivering the industry's fastest verifications, into its proprietary Verification Platform. The integration merges Informative Research's platform with Veri-Tax's verification services so lenders can access advanced validation tools that elevate the accuracy and reliability of borrower information.

Tax attorney to millionaires, Allie Petrova, warns about new IRS tactics against taxpayers | National News

GREENSBORO, N.C., March 12, 2024 (SEND2PRESS NEWSWIRE) -- It is official now: The Internal Revenue Service is going after high-income taxpayers who need to be filing returns, reporting income, and coming to terms with overdue taxes, penalties, and interest, cautions renowned tax attorney and national speaker Allie Petrova, founder of Petrova Law PLLC, a premier tax resolution law firm.

EnergyCAP Recognized as a Leader in Energy Management Software by Independent Research Firm | National News

BOALSBURG, Pa., Dec. 11, 2023 (SEND2PRESS NEWSWIRE) -- EnergyCAP, a leading provider of energy and sustainability enterprise resource planning (ERP) software, proudly announces its prestigious placement in the top right leader quadrant of the Verdantix Green Quadrant: Energy Management Software 2023. This accolade underscores EnergyCAP's commitment to delivering innovative and effective solutions in the energy & sustainability management sector.

TMC Emerging Technology Fund LP Invests in Halcyon to Better Serve Mortgage Industry

SAN DIEGO, Calif. /California Newswire/ -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") has made its latest investment in Halcyon. Halcyon's suite of services provides financial institutions with a 360-degree financial relationship with its customers by affordably expanding their offerings to include investment advisory, IRS transcripts and tax preparation services.

Celebrating Growth & Expertise: Matthew Weber Promoted to Principal at KROST CPAs

LOS ANGELES, Calif. /California Newswire/ -- KROST, a leading CPA and consulting firm, is thrilled to announce the promotion of Matthew Weber to the esteemed position of Principal. Matthew's dedication, experience, and exceptional contributions have led to this well-deserved advancement within the organization.

For the Second Year, PitBullTax Named to the 2023 Inc. 5000 List of Fastest Growing Private Companies in America | National...

CORAL SPRINGS, Fla., Aug. 16, 2023 (SEND2PRESS NEWSWIRE) -- PitBullTax Software, the Nation's Leading Tax Resolution Software for CPAs, EAs and Tax Attorneys has revealed it has won a spot on the 2023 Inc. 5000 list of the fastest growing private companies in America for the second year in a row.

City of Oxnard Calif. Awards Avenu Insights & Analytics With a Sales & Use Tax Auditing Contract

OXNARD, Calif. /California Newswire/ -- Avenu Insights & Analytics (Avenu), the leading provider of software administration and revenue recovery solutions for state and local governments, has achieved a significant milestone with the award of a Sales & Use Tax Auditing (SUTA) contract by the City of Oxnard, California.

Walker Reid Strategies, Inc. announces the launch of a new division providing outsourcing engineering services

BOCA RATON, Fla., July 18, 2023 (SEND2PRESS NEWSWIRE) -- Walker Reid Strategies, Inc. is proud to announce the launch of a new division that provides outsourcing engineering services. The division will support MEP firms, architects, engineers, ESCOS, and LEED professionals by supplementing labor shortages and reducing costs through energy modeling, BIM, and code compliance services.

Sustainable Organizations Embrace EnergyCAP’s Complete Suite of Energy and Sustainability ERP Solutions

STATE COLLEGE, Pa., June 27, 2023 (SEND2PRESS NEWSWIRE) -- EnergyCAP, a renowned provider of energy and sustainability enterprise resource planning (ERP) solutions, proudly announces The University of Texas Medical Branch (UTMB) and The University of New Mexico (UNM) have adopted EnergyCAP's newest solutions: CarbonHub and Wattics, making them the first customers to embrace EnergyCAP's complete solution suite.

Tax Help MD Provides Five Steps to Help Small Corporations Calculate QBI

WEST PALM BEACH, Fla., June 12, 2023 (SEND2PRESS NEWSWIRE) -- Tax Help MD helps self-employed individuals and small businesses to resolve tax issues. From basic tax filings to more complex situations, Tax Help MD wants its clients to come out on top. That's why it empowers them with information, so they can get the best tax benefits available.

JTC CPAs Takes Home Top Honors at Idaho’s Best Awards 2023, Solidifying Their Place as State’s Premier Accounting Firm

BOISE, Idaho, May 2 2023 (SEND2PRESS NEWSWIRE) -- JTC CPAs, a leading accounting firm based in Idaho, is thrilled to announce their recent award-winning recognition as the 2023 best accountant in both Treasure Valley and statewide in Idaho. Winning the 2023 Best CPA for Treasure Valley and Best Statewide Accountant in Idaho awards is a great achievement for JTC CPAs, and it reflects the firm's dedication to excellence in the field of accounting.

Accounting Today Names L.A.-based KROST Top 100 Firm and Regional Leader 2023

LOS ANGELES, Calif. /California Newswire/ -- KROST has been recognized as a Top 100 Firm by Accounting Today for the third year in a row. The firm ranked 72nd with a 16.60% change in revenue from the previous year. In addition, KROST has also been named a Regional Leader of 2023. The firm recently launched a new service, KROST Fund Admin Solutions, to further assist and add value for their clients.

Tax Court Case: Engineering Firm Overstated §179D Energy Efficient Commercial Building Property Deduction

COLUMBUS, Ohio, March 16, 2023 (SEND2PRESS NEWSWIRE) -- In a recent case, Michael Johnson, et ux. v. Commissioner, the tax court denied the majority of a taxpayer's Energy Efficient Commercial Building Deduction under IRC §179D since it claimed a §179D Deduction exceeding the cost of the Energy Efficient Commercial Building Property (EECBP), says ICS Tax, LLC.

Avenu Insights & Analytics Selected as Administrator for the City and County of Honolulu’s Transient Accommodations Tax

HONOLULU, Hawaii and CENTREVILLE, Va., March 2, 2023 (SEND2PRESS NEWSWIRE) -- Avenu Insights & Analytics (Avenu) is pleased to announce that it has been awarded a contract by the City and County of Honolulu to provide tax administration for transient accommodations tax (TAT), an important revenue source for the agency and its citizens.

KROST CPAs in Los Angeles Welcomes Grant Miller as Principal of Tax

LOS ANGELES, Calif. /California Newswire/ -- Los Angeles-based CPA firm, KROST CPAs & Consultants, welcomes Grant K. Miller, CPA, EA, as Principal of Tax. To begin his new role as Tax Principal, Grant will be based in our Woodland Hills office and he will provide direction and leadership to further the success of our tax department. He will also work closely with clients to manage their expectations for deliverables, services, and budgets.

EnergyCAP expands offering to include financial-grade carbon accounting

BOALSBURG, Pa., Jan. 24, 2023 (SEND2PRESS NEWSWIRE) -- EnergyCAP, a leading provider of energy and sustainability enterprise resource planning (ERP) software, today announced the launch of CarbonHub, a new solution that offers financial-grade carbon accounting and sustainability reporting.

Asset Defense Team and Vast Solutions Group Do Joint Venture

SEATTLE, Wash., Jan. 11, 2023 (SEND2PRESS NEWSWIRE) -- Asset Defense Team and Vast Solutions Group, Inc. (VastSolutionsGroup.com) are pleased to announce their joint venture, AssetDefenseAdv.com. This partnership brings together two leading companies in the asset protection and tax strategy industry, combining their expertise and resources to provide top-quality services to clients around the globe. The advanced platform is called "Einstein" and is currently in Beta 1.0.

Strategic Benefits Advisors offers guidance for plan sponsors as they seek to comply with landmark SECURE 2.0 retirement legislation

ATLANTA, Ga., Jan. 5, 2023 (SEND2PRESS NEWSWIRE) -- Independent, full-service employee benefits consulting firm Strategic Benefits Advisors, Inc. (SBA) issued a statement today outlining provisions of the newly enacted SECURE 2.0 Act of 2022 (SECURE 2.0) that are likely to affect most medium to large retirement plan sponsors.

Maxwell CPA Review provides online CPA courses to prepare students for the U.S. CPA exams

ORLANDO, Fla., Nov. 22, 2022 (SEND2PRESS NEWSWIRE) -- A new exam-prep company is helping students to pass the U.S. CPA exams in droves. Maxwell CPA Review was founded by Kyle Ashcraft, CPA and provides online CPA courses to prepare students for the U.S. CPA exams. Kyle passed all four CPA exams with a 90 and above, in only six months. Now he works to equip students with the same tools that prepared him for his exams.

Trust Administration 101: Absolute Trust Counsel to Hold Free Virtual Trust Administration Event for California CFPs and CPAs

WALNUT CREEK, Calif. /California Newswire/ -- Leading Bay Area estate planning firm Absolute Trust Counsel will host a free virtual event, The Absolute Trust Academy Trust Administration 101, on October 28, 2022, to equip CPAs and CFPs with a stronger knowledge of trust administration processes. The webinar is aimed at enhancing advisors' client services and relationships.

KROST CPAs & Consultants Acts as Exclusive Financial Advisor for American Range in Sale to Hatco

LOS ANGELES, Calif. /California Newswire/ -- American Range, a privately held manufacturer of commercial and residential cooking appliances, was sold to Hatco, an employee-owned manufacturer of warming, cooking, sanitizing, and cooling equipment. KROST CPAs & Consultants acted as the exclusive financial advisor to American Range in its transaction to Hatco Corporation.

INSIDE Public Accounting Names KROST Best of the Best Firm and 2022 Top 100 Firm

PASADENA, Calif. /California Newswire/ -- KROST CPAs & Consultants was recognized as the Best of the Best Firm and Top 100 Firm by INSIDE Public Accounting in 2022. Based on revenue, KROST was ranked 75th among the largest firms in the country, out of nearly 600 firms. With a net revenue of greater than $65 million, KROST was able to rise from the firm's previous ranking of 81st in 2021's IPA Survey and Analysis of Firms.

Matthew Weber and Jonathan Louie Appointed to LA-based KROST Principal in Development Program

Matthew Weber and Jonathan Louie Appointed to KROST's Principal in Development ProgramLOS ANGELES, Calif. /California Newswire/ -- Los Angeles-based CPA firm, KROST CPAs & Consultants, appoints Matthew Weber, CPA, MAcc, and Jonathan Louie, CPA, MST, to join KROST's Principal in Development (PID) program.

PitBullTax Software Named to the 2022 Inc. 5000 List of the Fastest Growing Private Companies in America

CORAL SPRINGS, Fla., Aug. 16, 2022 (SEND2PRESS NEWSWIRE) -- PitBullTax Software, the Nation's Leading Tax Resolution Software for CPAs, EAs and Tax Attorneys has revealed it has won a spot on the 2022 Inc. 5000 list of the fastest growing private companies in America.

KROST CPAs in Los Angeles Announce Paren Knadjian as Principal of M&A and Capital Markets and Brad Pauley as Principal of...

LOS ANGELES, Calif. /California Newswire/ -- Los Angeles-based CPA Firm, KROST CPAs and Consultants announced Paren Knadjian as Principal of M&A and Capital Markets and Brad Pauley as Principal of Tax. Knadjian has successfully completed over 200 M&A and Capital Markets transactions worth over $1 billion.

IRS Releases Updated Practice Unit for Auditing the 179D Energy Efficient Commercial Buildings Deduction

EGAN, Minn., June 27, 2022 (SEND2PRESS NEWSWIRE) -- The IRS Large Business and International (LB&I) Division released an updated Practice Unit for its agents to audit the 179D Energy Efficient Commercial Buildings Deduction (179D Deduction), ICS Tax, LLC announced today. It confirms that taxpayers can use the ASHRAE Standard 90.1-2007 rather than newer, more strict standards but also could be an indication that the IRS will have added scrutiny on 179D projects.

PitBullTax Software Integrates with Major Tech Companies to Further Dominate The IRS Tax Resolution Industry

CORAL SPRINGS, Fla., July 6, 2022 (SEND2PRESS NEWSWIRE) -- PitBullTax Software, the Nation's Leading IRS Tax Resolution Software for CPAs, EAs and Tax Attorneys has announced the release of Version 7.0. PitBullTax Software has licensees in all 50 states that rely on their software to prepare their clients' IRS resolution cases.

Business and Economic Empowerment Leader Dr. Velma Trayham Announced as Keynote Speaker for Takeaway Tax Business Conference in Houston, TX

HOUSTON, Texas, June 28, 2022 (SEND2PRESS NEWSWIRE) -- Highlighting the power of entrepreneurship to change the world and end poverty, award-winning B2B/diversity consultant and leader Dr. Velma Trayham (CEO of Thinkzilla Consulting Group) has been announced as the keynote speaker for TakeAway Tax's upcoming Tax Business Conference in Houston on Aug. 4.

The Importance of Integrity Within the Tax Consulting Industry

SAVAGE, Minn., June 1, 2022 (SEND2PRESS NEWSWIRE) -- Choosing a tax consulting firm as a trusted advisor is an exceptionally important decision for both businesses needing such services as well as accounting firms who refer them to their clients, says ICS Tax, LLC.

KROST CPAs in Pasadena Named to 2022 Top 100 Firms List by Accounting Today

PASADENA, Calif. /California Newswire/ -- KROST was recognized as a Top 100 Firm by Accounting Today. The firm ranked 76th with a 18.08% change in revenue from last year. KROST has now been ranked in this prestigious list two years in a row. With new services on the horizon, KROST continues to develop ways to add value for their clients.

KROST CPAs Recognized by Los Angeles Business Journal as among Top Accounting Firms in L.A. for 2022

PASADENA, Calif. /California Newswire/ -- KROST was recognized as one of Los Angeles Business Journals' Top 100 Accounting Firms in Los Angeles County, with 78% growth in revenue between 2020 and 2019, the firm is ranked 22nd on the list. KROST received this recognition during the Los Angeles Business Journal's Disruptor Awards virtual event.

KROST CPAs Announce Greg Kniss as Chairman of the Board, Jason Melillo as CEO and Keith Hamasaki as Principal of Assurance...

LOS ANGELES, Calif. /California Newswire/ -- Los Angeles-based CPA Firm, KROST CPAs and Consultants announced that Greg Kniss has been appointed to Chairman of the Board, Jason Melillo promoted as the new CEO, and Keith Hamasaki to Principal of Assurance & Advisory services.

KROST CPAs in Los Angeles Posts Record Year of M&A Advisory in 2021, Expects Trend to Continue in 2022

LOS ANGELES, Calif. /California Newswire/ -- KROST CPAs and Consultants reported a record year of M&A advisory work in 2021 and expects to remain equally busy in 2022. "We were involved in 21 buy-side and sell-side transactions in 2021," said Paren Knadjian, Head of M&A and Capital Markets at KROST.

EnergyCAP Names Lalit Agarwal Vice President, Energy Management and Sustainability

STATE COLLEGE, Pa., Jan. 19, 2022 (SEND2PRESS NEWSWIRE) -- EnergyCAP, LLC, the leading provider of energy management and utility bill processing software, today announced that Lalit Agarwal has been named Vice President, Energy Management & Sustainability.

IRS Mandates Additional Requirements for R&D Tax Credit Refund Claims

SAVAGE, Minn., Jan. 11, 2022 (SEND2PRESS NEWSWIRE) -- In 2007, the IRS made the Research & Development (R&D) tax credit a Tier 1 issue, says ICS Tax, LLC (ICS). Tier 1 issues were those of high strategic importance that had a significant impact on one or more industries, essentially meaning that the IRS would audit taxpayers filing amended returns on such issues. To taxpayers' relief, the Tiered Issue Process was eliminated in 2012, effectively placing the R&D tax credit in the same audit pool as other issues.

Certa Partners with Comply Exchange to Digitize Third Party Tax Journey

SARATOGA, Calif. /California Newswire/ -- Certa, the leading no-code third party risk management platform today announced its integration with Comply Exchange, a global leader in tax compliance. Certa is the only platform that digitizes, orchestrates, and automates the entire third-party journey across procurement, compliance, IT, legal, finance, and other groups.

EnergyCAP Appoints Thomas R. Patterson, Jr. as Chief Executive Officer

BOALSBURG, Pa., Nov. 5, 2021 (SEND2PRESS NEWSWIRE) -- EnergyCAP, LLC (ENC), the leading provider of data and analytics software for energy and utility bill management, today announced that Thomas R. Patterson, Jr. (Tom) has been named as Chief Executive Officer (CEO) of the company. Steve Heinz, who founded the company in 1982, will retire from his role as CEO but will continue in an advisory capacity as a member of the Board of Directors.

ICS Welcomes Adam Finesilver CPA to the New Alabama Office

MONTGOMERY, Ala., Aug. 26, 2021 (SEND2PRESS NEWSWIRE) -- ICS Tax, LLC is excited to announce its Southeast regional expansion with a new office in Montgomery, Alabama. ICS welcomes Adam Finesilver, CPA as its Regional Director. Adam brings over 13 years of experience providing tax advisory services to clients in real estate, financial and professional services industries.