Tag: Mortgage

Michigan-Based Liberty Title Deploys SafeWire to Protect Against Wire Fraud

COLUMBUS, Ohio, April 25, 2019 (SEND2PRESS NEWSWIRE) -- SafeChain, the industry leader in wire fraud prevention software and blockchain implementation for land title, announced today that Liberty Title, the fourth largest independent title company in Michigan, has selected SafeWire to safeguard wiring instructions as part of the firm's "Umbrella by Liberty Title" program.

SafeChain Announces Founding Title Partners in Blockchain Network

COLUMBUS, Ohio, April 22, 2019 (SEND2PRESS NEWSWIRE) -- SafeChain, in partnership with 9 independent title agents in Ohio, has launched a blockchain-backed network that enables peer-to-peer transfers of prior title insurance policies to streamline the title search process and drive down costs for member agencies.

LBA Ware to Exhibit in Innovation Alley at Second Annual FinTech South Conference

MACON, Ga., April 17, 2019 (SEND2PRESS NEWSWIRE) -- LBA Ware, provider of the leading automated incentive compensation and sales performance management platform for mortgage lenders, today announced that it will be an exhibiting company in Innovation Alley at FinTech South 2019, the Southeast's largest event dedicated to financial innovation.

SafeChain Partners with Adeptive to Provide Fraud-Free Closings for ResWare Customers

COLUMBUS, Ohio, April 16, 2019 (SEND2PRESS NEWSWIRE) -- SafeChain, an industry leader in wire fraud prevention software and blockchain applications for land title, announced today that Adeptive Software has integrated SafeWire into ResWare, Adeptive's powerful title and escrow production software.

Mid America Mortgage Hires Kerry Webb as Director of Business Development

ADDISON, Texas, April 11, 2019 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. announced today that it has hired Kerry Webb as Executive Managing Director of Business Development. In this role, Webb will be responsible for recruiting, managing and motivating teams of mortgage professionals to meet and exceed productions goals that align with the overall company's strategic volume growth and profitability goals.

Simplifile Promotes Mark Moats to VP of National Accounts

PROVO, Utah, April 11, 2019 (SEND2PRESS NEWSWIRE) -- Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced it has promoted Mark Moats to Vice President of National Accounts. Moats previously served as a Regional Sales Director for Simplifile and has been with the company for nearly 13 years.

National Lending Industry Leaders, Residential Capital Partners and 2020 REI Group, Join Forces

DALLAS, Texas, April. 8, 2019 (SEND2PRESS NEWSWIRE) -- Residential Capital Partners is pleased to announce the acquisition of 3L Finance. As a part of the acquisition, Residential Capital Partners is pleased to be the national hard money and rental finance lending partner to 2020 REI Group.

Matic Makes HousingWire’s List of Top Mortgage Tech Companies for Second Year in a Row

COLUMBUS, Ohio, April 8, 2019 (SEND2PRESS NEWSWIRE) -- Digital insurance agency Matic has been named to HousingWire's HW TECH100(TM) list of the top housing technology companies in the United States. The annual awards program, now in its sixth year, recognizes the most innovative tech firms in the real estate and mortgage finance sector.

Anow advances to final round of Mortgage Professional America’s Power Originator Summit Awards

RED DEER, Alberta, April 8, 2019 (SEND2PRESS NEWSWIRE) -- Anow, developer of appraisal firm management software that simplifies the way real estate appraisers manage their businesses, has been named a finalist for Mortgage Professional America's Power Originator Summit Award for Best Technology.

FormFree and Board Member Faith Schwartz Named Finalists for Mortgage Professional America Power Originator Summit Awards

ATHENS, Ga., April 5, 2019 (SEND2PRESS NEWSWIRE) -- Both FormFree and Faith Schwartz, a member of FormFree's board of directors, were named finalists for Mortgage Professional America's Power Originator Summit Awards. As nominees for the Best Rate Referrals Award for Best Technology and the RCN Capital Award for Woman of Distinction, FormFree and Schwartz were recognized at the inaugural Power Originator Summit at the Anaheim Convention Centre on April 4.

ARMCO Wins HousingWire HW Tech100 Award for Fifth Consecutive Year

POMPANO BEACH, Fla., April 4, 2019 (SEND2PRESS NEWSWIRE) -- ACES Risk Management (ARMCO), the leading provider of financial risk mitigation and compliance solutions, announced that it has won HousingWire's sixth annual HW Tech100(tm) award, which recognizes the 100 most innovative technology companies in the U.S. housing economy. This is the fifth consecutive year that ARMCO has achieved this prestigious designation.

NEXT and Housing Finance Strategies Form Strategic Alliance

WASHINGTON, D.C., April 4, 2019 (SEND2PRESS NEWSWIRE) -- NEXT Mortgage Events, creator of NEXT women's mortgage technology summit, today announced it has engaged in a strategic alliance with Housing Finance Strategies, a Washington, DC-based advisory firm led by renowned industry veteran and award winner Faith Schwartz, former executive director of HOPE NOW.

FormFree Named to HousingWire’s 2019 TECH100 List of Top Digital Mortgage Technology Companies

ATHENS, Ga., April. 4, 2019 (SEND2PRESS NEWSWIRE) -- FormFree(R) today announced that it has been named to HousingWire's list of the top 100 innovators in housing technology. Now in its sixth year, the HW TECH100(TM) awards program honors leading technology companies in all sectors of the U.S. housing economy, including residential mortgage lending, servicing and investments.

Texas Mortgage Bankers Association Releases Details for the 103rd Annual Convention

AUSTIN, Texas, April 3, 2019 (SEND2PRESS NEWSWIRE) -- The Texas Mortgage Bankers Association (TMBA) announced the agenda for its annual convention to be held on April 28 - 30, 2019 in San Antonio at the Marriott Rivercenter hotel. More than 1,000 industry participants are expected to at attend, which consists of comedian Dennis Miller as the keynote address, a list of preeminent speakers, educational tracks, networking opportunities, trending insights and a diverse mix of exhibitors.

LBA Ware Named a HousingWire TECH100 Company for 5th Straight Year

MACON, Ga., April 3, 2019 (SEND2PRESS NEWSWIRE) -- LBA Ware, provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that it has been named to HousingWire's 2019 TECH100 list of the housing industry's most impactful technologies. This marks the fifth consecutive year LBA Ware has been named to the list.

ReverseVision Named to HousingWire Magazine’s Tech100 List of Top Housing Technology Companies for a Fourth Year

SAN DIEGO, Calif. /California Newswire/ -- ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, today announced it has been named to HousingWire (HW) Magazine's Tech100 list of innovative housing technology companies for a fourth time. ReverseVision was previously named a HW Tech100 honoree in 2015, 2017 and 2018.

IDS Makes Fifth Appearance on HW TECH100

SALT LAKE CITY, Utah, April 2, 2019 (SEND2PRESS NEWSWIRE) -- Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has been named to the 2019 HW TECH100 list published by mortgage industry trade magazine HousingWire. IDS was part of the inaugural TECH100 list, and 2019 marks the fifth year IDS has made the list.

DocMagic Earns a Spot on the 2019 HW TECH100 – Sixth Straight Year

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of dynamic loan document preparation, automated regulatory compliance and comprehensive eMortgage solutions, announced that HousingWire has honored the company with the HW TECH100(tm) award for the sixth year in a row.

NEXT Wins PROGRESS in Lending Innovations Award

EDMOND, Okla., March 29, 2019 (SEND2PRESS NEWSWIRE) -- NEXT Mortgage Events LLC, creator of the NEXT women's mortgage tech summit, has announced that it was named a winner of the Innovations Award from PROGRESS in Lending Association.

Home Point Financial Partners with Matic to Offer Customers Lowest Market Rates on Homeowners Insurance

COLUMBUS, Ohio, March 26, 2019 (SEND2PRESS NEWSWIRE) -- Digital insurance agency Matic announced today that it has partnered with Home Point Financial Corporation ("Home Point"), a national, mortgage originator and servicer, to help its mortgage servicing customers find competitively priced homeowners insurance.

FormFree Joins Financial Data Exchange (FDX)

ATHENS, Ga., March 26, 2019 (SEND2PRESS NEWSWIRE) -- FormFree announced today that it has joined the Financial Data Exchange (FDX), a non-profit group that promotes information sharing and security standards for the financial sector. A leading provider of digital asset, income and employment verification, FormFree brings over a decade of experience in protecting the safety and integrity of sensitive consumer data.

Mid America COO Kara Lamphere Honored as ‘Tech All-Star’ by Mortgage Bankers Association

ADDISON, Texas, March 26, 2019 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. announced today that Mid America Chief Operating Officer Kara Lamphere was one of four mortgage technology innovators honored by the Mortgage Bankers Association (MBA) as a 2019 MBA Insights Tech All-Star. The award, now in its 18th year, recognizes "industry leaders who have made outstanding contributions in mortgage technology."

NotaryCam-DocMagic Integration Delivers Remote eClosing Capabilities for Mid America Mortgage

NEWPORT BEACH, Calif. /California Newswire/ -- NotaryCam, the leader in online notarization solutions, today announced that eMortgage pioneer Mid America Mortgage is now using the firm's integration with DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, to conduct remote online notarizations (RONs) through DocMagic's Total eClose platform.

LBA Ware Founder and CEO Lori Brewer Selected as 2019 Tech All-Star by Mortgage Bankers Association

MACON, Ga., March 25, 2019 (SEND2PRESS NEWSWIRE) -- LBA Ware(TM), provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that company Founder and CEO Lori Brewer has been named a winner of the 2019 MBA Insights Tech All-Star award. Brewer accepted her award today during the opening session of the Mortgage Bankers Association's Technology Solutions Conference & Expo 2019 in Dallas.

Global DMS Launches SnapVal to Provide Instant, Accurate, Guaranteed Appraisal Pricing Early on in the Origination Process

DALLAS, Texas, March 25, 2019 (SEND2PRESS NEWSWIRE) -- MBA's Technology Solutions Conference & Expo -- Global DMS, a leading provider of cloud-based valuation management software, today announced the official rollout of SnapVal(TM), an automated solution that utilizes the property address to return a guaranteed price on any residential appraisal in the U.S.

IDS Adds Full Mortgage eClosing Capabilities with Release of ClickToClose

SALT LAKE CITY, Utah, March 25, 2019 (SEND2PRESS NEWSWIRE) -- Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has augmented its flagship doc prep platform idsDoc to include full eClosing capabilities through a new service called ClickToClose.

OpenClose Extends its Digital Mortgage Ecosystem with New POS Offering – ConsumerAssist Digital POS

WEST PALM BEACH, Fla., March 22, 2019 (SEND2PRESS NEWSWIRE) -- OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that it is has scheduled a May release for the official rollout of its much anticipated digital mortgage point-of-sale (POS) solution, ConsumerAssist Digital POS.

NEXT Mortgage Conference Announces Summer Dates: Aug. 26-27, 2019

EDMOND, Okla., March 21, 2019 (SEND2PRESS NEWSWIRE) -- NEXT Mortgage Events LLC, creator of the NEXT women's mortgage tech summit, has announced its summer 2019 event dates. The event, hashtagged #NEXTSummer19, will take place Aug. 26-27, 2019 at The Gwen Hotel in Chicago. Registration will open to the public in April 2019.

National Association of Appraisers (NAA) and Anow forge partnership to bring cutting edge appraisal software to real property appraisers members

SAN ANTONIO, Texas and RED DEER, Alberta, March 19, 2019 (SEND2PRESS NEWSWIRE) -- Anow, creator of the leading software for real estate appraisal offices, today announced it has forged a partnership with the National Association of Appraisers (NAA) to make Anow's appraisal office management platform more readily accessible to members of the professional organization.

OpenClose LOS Platform, POS System and PPE Receives the Highest Overall Satisfaction and Lender Loyalty Score in STRATMOR’s New ‘Technology Insight...

WEST PALM BEACH, Fla., March 14, 2019 (SEND2PRESS NEWSWIRE) -- OpenClose, an industry-leading multi-channel loan origination system (LOS) and digital mortgage fintech provider, announced that STRATMOR Group's most recent Technology Insight Survey ranked the company's LOS platform, point-of-sale (POS) system, and product and pricing engine (PPE) as having the highest Overall Satisfaction and Lender Loyalty Score out of any vendor surveyed in the mortgage industry.

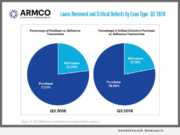

ARMCO Q3 2018 QC Trends Report: Defect Trends Reflect Lower Volume, Hyper-Competitive Market

POMPANO BEACH, Fla., March 14, 2019 (SEND2PRESS NEWSWIRE) -- ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report covers the third quarter (Q3) of 2018, and provides loan quality findings for mortgages reviewed by ACES Audit Technology.

The Mortgage Collaborative Adds 3 New Board Members, 45 Lender Members and Grows Attendance at 2019 Winter Conference

SAN DIEGO, Calif. /California Newswire/ -- The Mortgage Collaborative, a fast-growing independent mortgage cooperative of banks, credit unions and mortgage bankers, continues growth initiatives by adding three new mortgage executives to its Board of Directors. The new board members were voted in at their bi-annual member conference held in Austin, Texas.

ReverseVision Voted ‘Best in Show’ by Attendees of NEXT Women’s Mortgage Event in February

EDMOND, Okla., March 11, 2019 (SEND2PRESS NEWSWIRE) -- NEXT Mortgage Events LLC, a creator of events for women mortgage executives, has announced that ReverseVision has been voted Best in Show for the live technology showcase at its February 2019 technology conference. This distinction is awarded to the technology showcase participant that presented the most compelling solution, as determined by attendee vote.

Mid America Mortgage Earns Multiple Top Mortgage Workplace Honors

ADDISON, Texas, March 8, 2019 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. (Mid America) announced today that the company has been named a top mortgage workplace by two industry trade publications. In addition to garnering Top Mortgage Workplace honors by Mortgage Professional America (MPA), Mid America was also named a Top Mortgage Employer by National Mortgage Professional (NMP) in the magazine's January issue.

TRK Connection Named Ellie Mae Experience 2019 Sponsor and Exhibitor

SALT LAKE CITY, Utah, March 8, 2019 (SEND2PRESS NEWSWIRE) -- TRK Connection, a leading provider of mortgage quality control (QC) and origination management solutions, announced today it is a sponsor and exhibitor at Ellie Mae Experience 2019. The annual conference will be held March 10-13, 2019 at Moscone West in San Francisco, California.

Anow integrates Veros PATHWAY and VeroSELECT, adds VeroSCORE QC to appraisals submitted by mortgage lenders

RED DEER, Alberta, March 7, 2019 (SEND2PRESS NEWSWIRE) -- Anow, developer of appraisal firm management software that simplifies the way real estate appraisers manage their businesses, today announced appraiser productivity and appraisal quality integrations with Veros Real Estate Solutions (Veros(r)), a leading developer of enterprise risk management, collateral valuation and predictive analytics services.

Simplifile Now E-recording in 1,900 Counties Nationwide

PROVO, Utah, March 7, 2019 (SEND2PRESS NEWSWIRE) -- Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced that Logan County, Illinois, is the 1,900th jurisdiction to join Simplifile's e-recording network.

LBA Ware Named Ellie Mae Experience 2019 Exhibitor

MACON, Ga., March 6, 2019 (SEND2PRESS NEWSWIRE) -- LBA Ware, provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that it will exhibit at Ellie Mae Experience 2019, which will be held March 10-13, 2019, at Moscone West in San Francisco, California. This year's conference theme, "Driving Innovation Home," encourages attendees to learn about the latest technologies defining the mortgage industry.

FormFree to Help Kick Off Ellie Mae Experience 2019 as Welcome Reception Sponsor and Exhibitor

ATHENS, Ga., March 6, 2019 (SEND2PRESS NEWSWIRE) -- FormFree(R) announced it will help kick off Ellie Mae's (NYSE: ELLI) annual user conference, Ellie Mae Experience 2019, as a sponsor of the event's welcome reception and "wine tasting tour" on Monday, March 11. Ellie Mae Experience 2019 takes place March 10-13 at the Moscone Center in San Francisco.

TRK Connection Hires Chris Bruner as Senior Vice President of National Sales

SALT LAKE CITY, Utah, March 4, 2019 (SEND2PRESS NEWSWIRE) -- TRK Connection (TRK), a leading provider of mortgage quality control (QC) and origination management solutions, announced today it has hired Chris Bruner, CMB, AMP, as Senior Vice President of National Sales.

Matic Obtains SOC 2 Type II Certification

COLUMBUS, Ohio, Feb. 28, 2019 (SEND2PRESS NEWSWIRE) -- Matic, the digital homeowners insurance marketplace built for mortgage servicers and lenders, announced that it has successfully completed a Service Organization Control (SOC) 2 Type II audit. Conducted by IS Partners, LLC, a globally recognized certified public accounting firm, the audit verifies that Matic's information security practices.

IDS Makes National Mortgage Professional’s Inaugural List of Top Mortgage Workplaces

SALT LAKE CITY, Utah, Feb. 28, 2019 (SEND2PRESS NEWSWIRE) -- Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has been named to National Mortgage Professional magazine's inaugural list of Top Mortgage Employers in the Service Providers category. IDS was one of only 10 service providers to be recognized on this year's list.

Major Utah Title Agency Cottonwood Title Selects SafeWire from SafeChain

COLUMBUS, Ohio, Feb. 26, 2019 (SEND2PRESS NEWSWIRE) -- SafeChain, the industry leader in wire fraud prevention software and blockchain implementation for land title, announced today that Cottonwood Title Insurance Agency, Inc., one of the largest independent title agencies in Utah, has adopted SafeWire(TM) to protect the wire transactions facilitated by its agents across the Wasatch Front.

TRK Connection Announces Enhanced Integration with Ellie Mae’s Encompass Digital Mortgage Solution

SALT LAKE CITY, Utah, Feb. 25, 2019 (SEND2PRESS NEWSWIRE) -- TRK Connection (TRK), a leading provider of mortgage quality control (QC) and origination management solutions, announced that its flagship mortgage QC audit platform Insight Risk & Defect Management (RDM) is now available through the Ellie Mae Encompass Digital Lending Platform via Ellie Mae's Encompass Partner Connect APIs.

National Mortgage Professional Magazine Names United Fidelity Funding Corp. a 2019 Top Mortgage Employer

KANSAS CITY, Mo., Feb. 22, 2019 (SEND2PRESS NEWSWIRE) -- United Fidelity Funding Corp. (UFF), a rapidly growing national mortgage banker, announced that it was designated a Top Mortgage Employer for 2019 by National Mortgage Professional (NMP) magazine.

FormFree Honored as Top Mortgage Workplace by Mortgage Professional America Magazine

ATHENS, Ga., Feb. 21, 2019 (SEND2PRESS NEWSWIRE) -- FormFree has been named to Mortgage Professional America's (MPA) list of Top Mortgage Workplaces. MPA's inaugural awards program recognized 32 of the best employers in the mortgage industry, which included a mix of lenders, brokers, appraisal management companies and technology vendors.

LBA Ware’s Outstanding Corporate Culture Garners the Firm Multiple Honors as a Top Mortgage Workplace

MACON, Ga., Feb. 21, 2018 (SEND2PRESS NEWSWIRE) -- LBA Ware, provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that the company has been named a top mortgage workplace by two industry trade publications.

Simplifile Named a Top Mortgage Workplace by Mortgage Professional America

PROVO, Utah, Feb. 21, 2019 (SEND2PRESS NEWSWIRE) -- Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced that it has garnered a spot on the inaugural Top Mortgage Workplace list, sponsored by industry trade publication Mortgage Professional America (MPA).

OpenClose Integrates its LOS with Continuity Programs’ Mortgage CRM

WEST PALM BEACH, Fla., Feb. 21, 2019 (SEND2PRESS NEWSWIRE) -- OpenClose, an industry-leading multi-channel loan origination system (LOS) and digital mortgage fintech provider, announced it has completed an integration with Continuity Programs, Inc.'s cloud-based MyCRMDashboard.com customer relationship management (CRM) software.

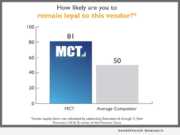

Mortgage Capital Trading (MCT) Scores High Marks in Satisfaction, Lender Loyalty, and Functionality Effectiveness According to Recent Study by STRATMOR Group

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that the 2018 STRATMOR Technology Insight Study rated MCT as the leader in overall satisfaction, lender loyalty, and functionality effectiveness in the production pipeline hedging industry, according to survey respondents.