SAN FRANCISCO, Calif. /California Newswire/ — Aclaro, the leading provider and developer of Artificial Intelligence and Blockchain-based technology solutions, announces the launch of their newest Fintech App in conjunction with the opening of a new office in San Francisco, California.

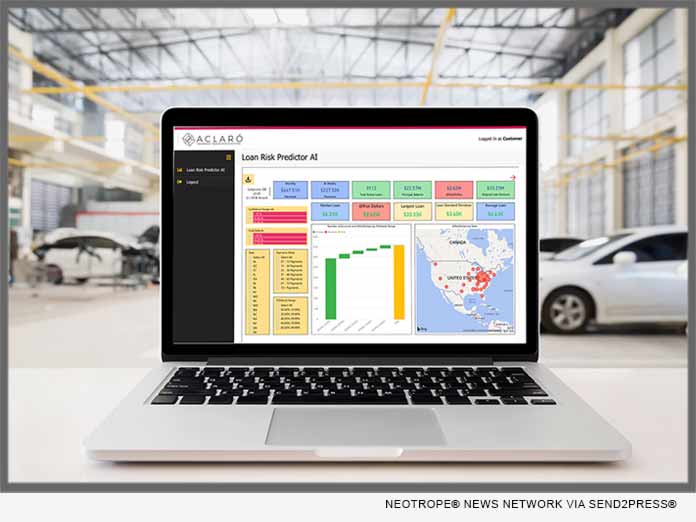

The Aclaro Loan Repayment Risk Artificial Intelligence (AI) System was developed to predict the probability of payment default of a subprime loan and was officially released on December 10, 2018. The increase in demand for artificial intelligence/actionable solutions is transforming many facets of the day-to-day business and consumer activities and processes. Aclaro is at the forefront of helping the lending industry shift gears in order to adapt to these trends.

“Aclaro has provided us a lucid and a deeper understanding of the risks associated with our loan portfolio. The Aclaro Loan Repayment Risk System allows us to look at repayment risk on a daily basis. We now have the accuracy needed to make decisions based on timely facts and identify risks faster. Looking at risks such as loans that have a 90% of default with a 90%+ confidence level on a daily basis is a game changer for us and the industry!” said Ben Stefanovski, President of Tracir Financial Services.

Today’s top companies are remaining profitable by finding new and innovative methods of optimizing their most valuable asset: Data. Aclaro Risk Management uses machine learning algorithms to analyze a lender’s loan portfolio. The risk management system optimizes Artificial Intelligence and Big Data in order to calculate a risk score for each borrower in the portfolio. Key components include a full Web based Business Intelligence Front End solution and subsecond decisioning of an active loan.

It’s based on a combination of 100+ individual variables associated with borrower, loan terms, insurance coverage, employment, and vehicle data, but Aclaro never utilizes information such as name, income, social security numbers or credit scores from a Credit Bureau in any of its processes.

Aclaro allows businesses to maximize their goldmine of customer data to make smarter decisions. It specifically helps lenders determine which borrowers are at risk of default.

“With the launch of this new risk management solution, Aclaro is disrupting the status quo of the market by providing lenders the high-level technological tools they need to compete in today’s modern marketplace,” said Farshad Fatouhi PhD, CTO of Aclaro, Inc.

Carlos Galarce, CEO of Aclaro added: “We’re excited about adding this product to our ‘Know Your Customer’ Relationship Building Solutions Portfolio, and the opening of our third office in the San Francisco Bay area to keep up with the growing demand in the Fintech industry.”

About Aclaro:

Based in Miami, Florida, Aclaro specializes in providing small and medium-sized businesses with Blockchain and Artificial Intelligence Technology. With these tools, companies can better optimize their customer experience, make better decisions, and make improvements in efficiency and cost savings.

Visit aclaro.io to learn more about the company and their innovative business solutions. If you would like to see their products in use, contact the sales team at +1-833-2ACLARO or visit: https://hubs.ly/H0fSK9G0

Aclaro, Inc., 78 SW 7th St., Suite 500, Miami, FL 33130, USA. Web: https://aclaro.io/

VIDEO (Vimeo):

Learn More: https://aclaro.io/

This version of news story was published on and is Copr. © 2018 California Newswire® (CaliforniaNewswire.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.