EPIC Insurance Brokers Acquires Book of Business of Brokers Insurance Mart, Inc. (BIM)

LIVERMORE, Calif. /California Newswire/ -- EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, announced today that it acquired in an asset sale the book of business of Brokers Insurance Mart, Inc. (BIM) on April 15, 2019.

NotaryCam and Milo Credit Team To Complete International Remote Online Closing Transaction

NEWPORT BEACH, Calif. /California Newswire/ -- NotaryCam(R), the pioneering leader in online notarization and original provider of mortgage eClosing solutions, today announced that it has partnered with Milo Credit to complete the lender's first remote online closing (ROC) transaction.

Mortgage Capital Trading (MCT) Bolsters Executive Management Team with Addition of Leslie Winick as Chief Strategy Officer

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that Leslie Winick has joined the company as Chief Strategy Officer (CSO). In this newly created position, Ms. Winick will play an integral role in helping MCT hone its strategic direction, further increase market share, manage rapid growth, and delight clients.

At 2019 Retail Asset Protection Conference EPIC’s Kevin Ach and Walter Palmer to Present on Business Continuity and Theft

SAN FRANCISCO, Calif. /California Newswire/ -- EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, announced today that Practice Leader Walter Palmer will facilitate a session on May 6 at Retail Asset Protection Conference and Vice President of Risk Assurance Kevin Ach will present on May 7 at the Gaylord Rockies Resort in Denver.

Absolute Trust Talk with Kirsten Howe: Tax Law Changes Impact Charitable Giving – Is Philanthropy Motivated by Tax Reasons Dead?

WALNUT CREEK, Calif. /California Newswire/ -- Absolute Trust Talk, a monthly podcast released by Absolute Trust Counsel, recently sat down with Michael Crvarich, Vice President of Legacy Giving at the John Muir Health Foundation, to discuss how an individual's core value system is the new driving force behind charitable giving.

Bank of Southern California, N.A. Appoints Rick Beatty Vice President, Underwriter

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, has named Rick Beatty Vice President, Underwriter. He will be responsible for structuring, analyzing and underwriting commercial credit for small to middle market companies as well as managing an existing portfolio of clients.

Tiffany McClellan of EPIC to Present on Designing Benefits Plans at HRE Health and Benefits Leadership Conference

SAN FRANCISCO, Calif. /California Newswire/ -- EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, announced today that Regional Director of Employee Benefits Tiffany McClellan, CEBS, will present at the Human Resource Executive (HRE) Health & Benefits Leadership Conference on Thursday, April 25 at 11:30 a.m. at the Aria Resort & Casino in Las Vegas.

Mortgage Capital Trading Reorganizes Sales Processes, Expands National Sales Team, and Forms Customer Success Group

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, today announced it has restructured the company's internal sales processes, bolstered the sales team, and launched a Customer Success Group (CSG). Implementation of the changes pave the way for significant growth as the company continues innovating, launching new products and services, and on-boarding clients.

Bank of Southern California NA Names Tony DiVita Chief Operating Officer

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, has named Tony DiVita Executive Vice President, Chief Operating Officer. Mr. DiVita joined Bank of Southern California in 2011 and most recently held the position of Executive Vice President, Chief Banking Officer.

Reconciled Expands with New Los Angeles Location providing Online Bookkeeping Services for Entrepreneurs

LOS ANGELES, Calif. /California Newswire/ -- Reconciled is pleased to announce the opening of a new satellite office in Los Angeles. The online bookkeeping firm for entrepreneurs launched a L.A. office in partnership with local bookkeeping firm Logistis to expand services to entrepreneurs in the greater L.A. region.

Bank of Southern California NA Names Gaylin Anderson to Chief Banking Officer

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, has appointed Gaylin Anderson Executive Vice President, Chief Banking Officer. Mr. Anderson previously served as Executive Vice President, Market Executive, and was responsible for the bank's growth within the newly added Los Angeles and Orange County markets.

Bank of Southern California NA Extends Loan Facility to San Diego’s NTC Foundation

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCA), a community business bank headquartered in San Diego, Calif., announced today that it has extended a loan facility to the NTC Foundation, a San Diego-based non-profit organization focused on creating a destination for arts and culture at the former Naval Training Center in San Diego.

Bank of Southern California NA Appoints Ashley Lopez as Branch Managing Director in Carlsbad

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, has announced the appointment of Ashley Lopez as Branch Managing Director for the company's Carlsbad office. She will be responsible for expanding Bank of Southern California's market presence by actively seeking new business banking relationships with a focus on San Diego's North County communities.

Britt Haven of MQMR Receives Achievement Certification from the MBA’s Certified Mortgage Compliance Professional Program

LOS ANGELES, Calif. /California Newswire/ -- Mortgage Quality Management and Research, LLC (MQMR) announced today that its National Account Executive Britt Haven has completed Level I of the Certified Mortgage Compliance Professional (CMCP) Certification and Designation program offered by the Mortgage Bankers Association (MBA).

MCT CMO Ian Miller Named a 2019 ‘Top 40 Most Influential Mortgage Professionals Under 40’ by NMP

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT) a leading mortgage hedge advisory and secondary marketing software firm, announced that its Chief Marketing Officer, Ian Miller, was recognized by National Mortgage Professional Magazine's (NMP) for his industry accomplishments, landing him on the 2019 'Top 40 Most Influential Mortgage Professionals Under 40' list.

The Mortgage Collaborative Adds 3 New Board Members, 45 Lender Members and Grows Attendance at 2019 Winter Conference

SAN DIEGO, Calif. /California Newswire/ -- The Mortgage Collaborative, a fast-growing independent mortgage cooperative of banks, credit unions and mortgage bankers, continues growth initiatives by adding three new mortgage executives to its Board of Directors. The new board members were voted in at their bi-annual member conference held in Austin, Texas.

Bank of Southern California, N.A. Continues to Expand Its Business Development Team in Los Angeles

LOS ANGELES, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, is pleased to announce the expansion of its business development team in the Los Angeles market with the hiring of two seasoned banking professionals to support the company's continued growth and expansion in the Southern California region.

Risk & Insurance Honors 8 of EPIC Brokers’ Consultants as 2019 Power Brokers

SAN FRANCISCO, Calif. /California Newswire/ -- EPIC Insurance Brokers and Consultants, a retail property and casualty insurance brokerage and employee benefits consultant, announced today that Alexander Brown (Environmental), DeAnna Buck (Captives), Alexandra Forcucci (Real Estate), Maron Impagliazzo (Transportation), Matt Sears (Employee Benefits), and Neil Slattery (Retail) have been recognized as 2019 Power Brokers(R) by Risk & Insurance(R) magazine. Lawrence Kirshner (Employee Benefits) and Laura Tesoriero (Retail) were named as finalists.

PowerGuard Specialty Insurance Launches Residential Solar Protection Program for Dealers and Installers

IRVINE, Calif. /California Newswire/ -- PowerGuard Specialty Insurance Services - a renewable energy program manager based in the United States - announced today the availability of a unique, first of its kind, insured full-system warranty for residential solar installations, including solar panels, wiring/leads and inverters.

Base Zero’s New Crypto Custody Keeps Financial Institutions Safe from Theft and Fraud

BERKELEY, Calif. /California Newswire/ -- Multi-signature transaction authorization has become more secure and more convenient, thanks to Base Zero's handheld signer devices. The devices work in combination with flexible security software that smoothly integrates with existing financial systems. Base Zero institutional crypto custody enables offline safekeeping of client crypto assets while maintaining 24/7 real-time asset access and transaction capability.

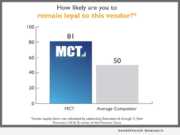

Mortgage Capital Trading (MCT) Scores High Marks in Satisfaction, Lender Loyalty, and Functionality Effectiveness According to Recent Study by STRATMOR Group

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that the 2018 STRATMOR Technology Insight Study rated MCT as the leader in overall satisfaction, lender loyalty, and functionality effectiveness in the production pipeline hedging industry, according to survey respondents.

Bank of Southern California, N.A. Announces Q4-2018 and Year End Financial Results

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL) announced quarterly net income of $2.0 million for the fourth quarter of 2018, compared to $875 thousand in the third quarter of 2018 and $1.1 million for the fourth quarter of 2017. For the year ended December 31, 2018, net income was $5.3 million compared to $4.0 million for the year ended December 31, 2017.

Bank of Southern California, NA Names Scott Yates as Regional Managing Director

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, has expanded its business development team with the appointment of Scott Yates as Group Managing Director of Branch Sales and Deposit Origination. He will be responsible for leading the branch banking group in their efforts to grow the bank's core deposits, deepening existing client relationships and originating new client relationships.

EPIC Holdings Inc. Finalizes its Acquisition of Integro USA

SAN FRANCISCO, Calif. /California Newswire/ -- EPIC Holdings, Inc. ('EPIC') today announced the closing of EPIC's acquisition of Integro Holdings Inc. (substantially all of the U.S. operations of Integro Group Holdings). Please see our press release issued on December 17, 2018 that follows for more details and comments on the transaction.

Bank of Southern California, N.A. Names John E. Chung as Group Managing Director

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, has announced the appointment of John Chung as Group Managing Director of Business Banking. He will be responsible for leading the team's impact of meeting the banking needs of small to medium sized businesses throughout Southern California.

NotaryCam Helps East Texas Title Complete Its First Remote Online Closing (ROC)

NEWPORT BEACH, Calif. /California Newswire/ -- NotaryCam(R), the pioneering and market leader in remote online notarization and mortgage eClosing solutions, today announced that East Texas Title has executed its first remote online closing (ROC(TM)) in Texas since the state's remote online notarization law went into effect. The transaction, which was executed using NotaryCam's eClose360(R) eClosing platform, was performed on behalf of a couple currently located in Colorado and selling their property in Longview, Texas.

Fintech provider Cloudvirga closes 2018 with customers producing nearly $200B in loan volume, secures $50m in capital

IRVINE, Calif. /California Newswire/ -- Cloudvirga(TM), a leading provider of digital mortgage software, closed the books on 2018 with a 54 percent year-over-year increase in mortgage loan volume processed through its intelligent Mortgage Platform(TM). The strong 2018 results topped a long list of achievements.

EPIC Insurance Brokers and HR Hotlink Partner for the Benefit of CNCDA Members

SAN FRANCISCO, Calif. /California Newswire/ -- EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, announced today a marketing and distribution agreement with HR Hotlink. Both firms are longtime valued partners of the California New Car Dealers Association (CNCDA).

Bank of Southern California, N.A. Names Bill Lamison VP, Underwriter

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL), a community business bank headquartered in San Diego, has announced the appointment of Bill Lamison as Vice President, Underwriter. He will join the company's established business banking team and will be responsible for structuring, analyzing and underwriting commercial credit for new clients as well as managing an existing portfolio of customers.

Dan Sogorka, Former FNF/Black Knight executive joins Cloudvirga as chief revenue officer

IRVINE, Calif. /California Newswire/ -- Cloudvirga, a leading provider of digital mortgage software, today announced the appointments of Dan Sogorka as chief revenue officer and Kelly Kucera as senior vice president of marketing. Sogorka, a seasoned mortgage technology executive, will drive Cloudvirga's continued revenue growth and oversee the firm's sales and marketing strategy with the help of veteran cloud technology marketer Kucera.

EPIC Insurance Adds Blake Kirk as a Principal in San Francisco

SAN FRANCISCO, Calif. /California Newswire/ -- EPIC Insurance Brokers and Consultants announced today that risk management and insurance professional Blake Kirk has joined the firm's operations in Northern California as a Senior Vice President and Principal.

Randy Pizer Joins EPIC Insurance Brokers in Orange County, Calif.

IRVINE, Calif. /California Newswire/ -- EPIC Insurance Brokers and Consultants ('EPIC') announced today that risk management and insurance professional Randy Pizer has joined the firm's operations in California as Vice President/Account Executive.

Former Houzz and Drip leader, Ashley Lundquist, joins Cloudvirga as vice president of talent

IRVINE, Calif. /California Newswire/ -- Cloudvirga, a leading provider of digital mortgage software, today announced the appointment of Ashley Lundquist as vice president of talent. Lundquist will oversee the firm's initiatives to attract, develop and retain top technology talent as Cloudvirga rapidly expands its team.

The Mortgage Collaborative Adds 44 New Lender Members in 2018, Now Growing Staff to Serve 2019 Expansion

SAN DIEGO, Calif. /California Newswire/ -- The Mortgage Collaborative (TMC), the mortgage industry's only independent cooperative, today announced it added 44 new lender member companies in 2018, its strongest year ever for new member growth. To help support the significant growth of their network, TMC has also added Sarah Oldani and Jennifer Haning to their staff.

Bank of Southern California NA Names Lori Boucher VP Branch Manager, La Quinta Branch

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, has named Lori Boucher Vice President, Branch Manager. She will be responsible for sales and service of both consumer and business relationships at Bank of Southern California's La Quinta branch in Coachella Valley.

SecurityNational Mortgage Corp. Implements Fully Paperless Closing Process Using DocMagic’s Total eClose Platform

TORRANCE, Calif. /California Newswire/ -- DocMagic, Inc., the premier provider of fully-compliant and document preparation, regulatory compliance and comprehensive eMortgage services, and SecurityNational Mortgage Corporation (SNMC), an independent national mortgage banker, jointly announced that they successfully rolled out DocMagic's comprehensive Total eClose(TM) platform.

Bank of Southern California Adds Joshua Mello, Managing Director, in San Diego

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, has announced the appointment of Joshua Mello as Managing Director. He will be responsible for developing and managing a portfolio of commercial clients in the greater San Diego region.

EPIC Holdings to Acquire Integro Holdings Inc.

SAN FRANCISCO, Calif. /California Newswire/ -- EPIC Holdings, Inc. today announced an agreement to acquire Integro Holdings Inc., which houses substantially all of the U.S. operations of Integro Group Holdings, LP. Founded in 2005, Integro has built a highly successful specialty insurance brokerage and consulting business in the U.S. with revenue in excess of $150 million.

In Virginia, NotaryCam & Stewart Title Execute First Complete Purchase and Sale Mortgage Transaction via Remote Online Closing

NEWPORT BEACH, Calif. /California Newswire/ -- NotaryCam(R), the leader in online notarization and the original provider of mortgage eClosing solutions, today announced it has completed the first remote online closing (ROC) for a purchase and sale transaction in Virginia in conjunction with Stewart Title(R).

Tim Von Kaenel, Former loanDepot executive joins Cloudvirga as chief product officer

IRVINE, Calif. /California Newswire/ -- Cloudvirga(TM), a leading provider of digital mortgage software, announced it has appointed Tim Von Kaenel to the role of chief product officer. In this role, Von Kaenel will oversee product strategy, design and go-to-market planning for Cloudvirga's growing suite of digital mortgage point-of-sale products. Von Kaenel will report to Cloudvirga CEO Michael Schreck.

Bank of Southern California, N.A. Hires Pamela Marble as Managing Director in Orange County CA

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, has announced the appointment of Pamela Marble as Managing Director in Orange County. In this role, she will be responsible for business development and client relationship management.

Bank of Southern California NA Opens West Los Angeles Office, Fifth In County

LOS ANGELES, Calif. /California Newswire/ -- Bank of Southern California, N.A. ( OTC Pink: BCAL / OTCMKTS:BCAL ), a community business bank headquartered in San Diego, Calif., is pleased to announce its continued expansion in Los Angeles with the opening of a new production office in West Los Angeles.

EPIC Insurance’s David McNeil Named 2018 ‘Broker of Excellence’ by CalMutuals Joint Powers Risk & Insurance Management Authority

ONTARIO, Calif. /California Newswire/ -- EPIC Insurance Brokers and Consultants ("EPIC"), a retail property, casualty insurance brokerage and employee benefits consultant, announced today that Principal and Risk Management Consultant David McNeil has been selected as a 2018 Broker of Excellence by The California Association of Mutual Water Companies - Joint Powers Risk & Insurance Management Authority (CalMutuals-JPRIMA).

Cloudvirga taps former Altisource CTO James Vinci as Executive VP of Technology

IRVINE, Calif. /California Newswire/ -- Cloudvirga(TM), a leading provider of digital mortgage software, today announced that mortgage industry veteran James Vinci has been selected to fill the firm's newly created executive vice president of technology position. In this role, Vinci will execute Cloudvirga's technical vision, oversee initiatives to strengthen developer talent and collaborate across departments to scale technical initiatives to the company's explosive growth.

EPIC Insurance Buys Direct Retail Wine Industry Business From Paragon

SAN FRANCISCO, Calif. /California Newswire/ -- EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, announced today the purchase of a retail wine industry book of business from Managing General Agency (MGA) Paragon Insurance Holdings LLC. The accounts in question came to Paragon in the fall of 2017 when they acquired wine industry specialist John Sutak Insurance Brokers, along with two winery programs from the Argo Group.

Paragon Insurance Holdings LLC to Sell its Direct Retail Wine Industry Business

SAN FRANCISCO, Calif. /California Newswire/ -- Paragon Insurance Holdings LLC today announced the sale of the firm's direct retail wine industry business to retail insurance broker EPIC Insurance Brokers & Consultants. The accounts in question came to Paragon in the fall of 2017 when they purchased wine industry specialist John Sutak Insurance Brokers, along with two winery programs from the Argo Group.

MCT Inc. Hires Rhiannon Bolen as Regional Sales Manager to Satisfy Increasing Demand for its Product and Service Offerings

SAN DIEGO, Calif. /California Newswire/ -- Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that Rhiannon Bolen has joined the company's sales team as one of its Regional Sales Managers and will be responsible for overseeing the Southern territory.

Former Roostify exec Jesse Decker joins Cloudvirga as chief customer success officer

IRVINE, Calif. /California Newswire/ -- Cloudvirga, a leading provider of digital mortgage software, today announced the appointment of Jesse Decker to the role of chief customer success officer. Decker will lead the company's customer success division and work collaboratively with its product development and marketing teams to help leading mortgage lenders leverage the full potential of Cloudvirga's revolutionary point-of-sale (POS) products.

Bank of Southern California, N.A. Announces its Q3-2018 Financial Results (BCAL)

SAN DIEGO, Calif. /California Newswire/ -- Bank of Southern California, N.A. (OTC Pink: BCAL) announced quarterly net income of $874,988 for the third quarter of 2018, compared to $1,088,043 for the third quarter of 2017. For the nine months ended September 30, 2018, net income was $3,253,441, compared to $2,830,295 for the nine months ended September 30, 2017. Results for the quarter and nine months ended Sept. 30, 2018, include approximately $1.2 million and $1.6 million, respectively, in expenses related to the acquisition of Americas United Bank (OTC Pink: AUNB), which was completed on July 31, 2018.

For U.S. Veterans and Service Members, NotaryCam again Offers Complimentary Notarizations Honoring 2018 Veterans Day

NEWPORT BEACH, Calif. /California Newswire/ -- NotaryCam(R) today announced it would offer free remote online notarization (RON) sessions to United States veterans and current service members in honor of Veterans Day as part of its semi-annual "Help a Hero" initiative. From Friday, November 9 through Monday, November 12, active duty and retired service members can connect to a live notary public via NotaryCam's secure virtual signing room to legally notarize, sign and execute documents and agreements online from anywhere in the world.