SAN DIEGO, Calif. /California Newswire/ — Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 15.36% in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

Despite facing headwinds of increasing rates, mortgage lock volume continues its upward trajectory as we enter the buying season. Although rates currently stand at 7%, historically high compared to recent years, they are expected to decline, enticing buyers to make purchases now with the anticipation of refinancing when rates begin to drop.

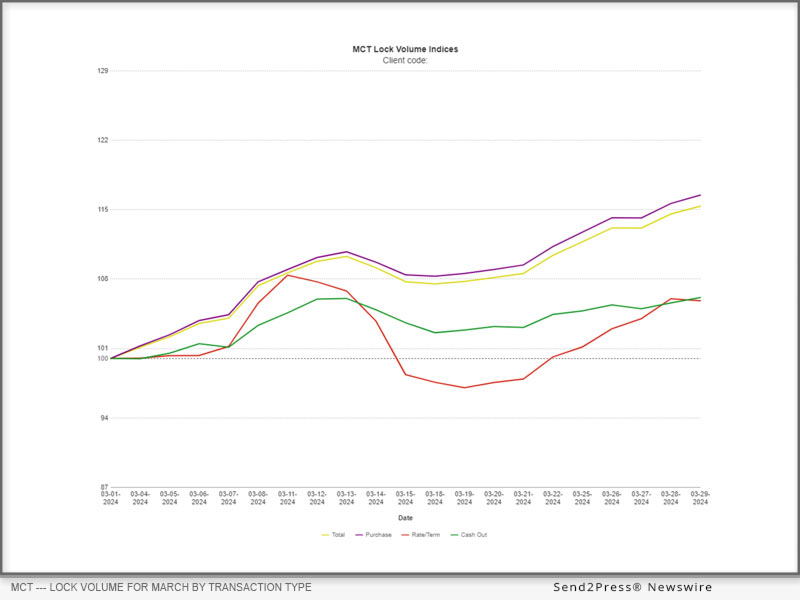

While the recent months have witnessed a steady rise in lock volume, it’s important to note that volumes remain on the lower end of the scale, resulting in perceived significant month-over-month increases. The lock volume indices reveal an 8% year-over-year increase, predominantly fueled by a 44% surge in refinances compared to this time last year.

Andrew Rhodes, Senior Director and Head of Trading at MCT, remarked, “Even amidst the challenges posed by higher rates, we continue to witness incremental increases in lock volume. Market expectations indicate a 50% chance for a rate cut in June. However, robust economic data in the coming months may delay rate cuts until July or September, potentially resulting in sideways or even lower production.”

To access the comprehensive insights provided by MCT’s Lock Volume Indices, interested parties are encouraged to download the full report – https://mct-trading.com/press-release/lock-volume-increase-15-percent-into-buying-season/.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

High-res image of chart: https://mct-trading.com/wp-content/uploads/2024/04/mct-lock-volume-indices-12.png

Learn More: https://mct-trading.com/

This version of news story was published on and is Copr. © 2024 California Newswire® (CaliforniaNewswire.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.