SAN DIEGO, Calif. /CALIFORNIA NEWSWIRE/ — Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 3.17% increase in mortgage lock volume compared to the previous month. The report highlights key market dynamics, offering industry professionals valuable insights. Industry professionals and enthusiasts are invited to download the complete report for comprehensive insights into the market dynamics.

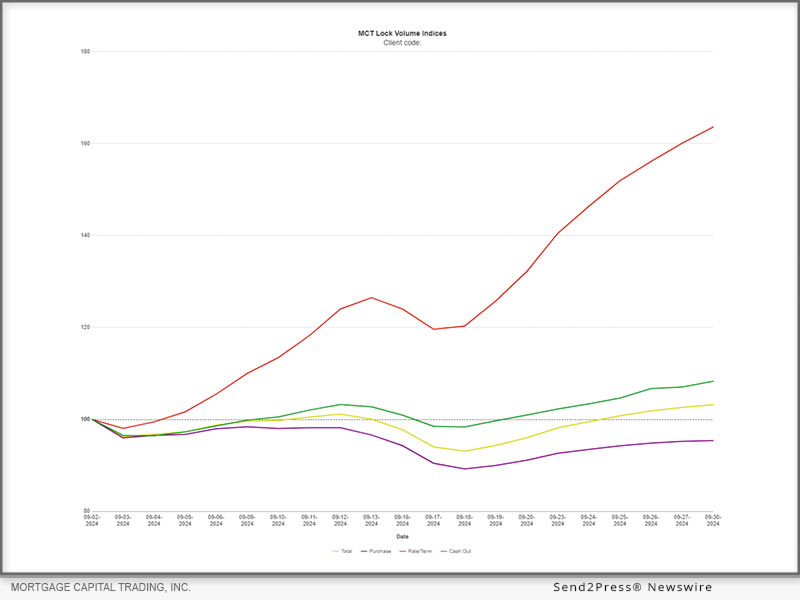

Image caption: MCT Reports 3% Increase in Mortgage Lock Volume, Refinance Activity Buoys Market.

August and September have seen a continued slowdown in purchase lock volume, as is typical following the summer buying season. However, refinance activity has shown a steady increase, strong enough to offset the usual decline in overall lock volume from August to September. This increase in refinance activity has contributed to maintaining total lock volume production.

“This data signals a potential shift in strategy for loan officers, who are increasingly targeting borrowers looking to refinance after securing mortgages at higher peak rates,” said Andrew Rhodes, Senior Director and Head of Trading at MCT. “However, for a more significant rise in refinance activity, mortgage rates will need to drop much further. Currently, many borrowers remain locked into historically low rates, making the potential for increased refinance volume contingent on further rate reductions outside of market expectations.”

Rhodes also pointed to the significance of upcoming economic indicators. “With the expected Fed rate cuts already factored in, the market is now turning its attention to Friday’s Nonfarm Payroll report and the next Consumer Price Index release for signs of where rates are headed,” he added.

As the industry navigates these evolving market conditions, MCT continues to provide critical insights and cutting-edge solutions for mortgage professionals.

For further insights into the current mortgage market and the latest trends in lock volume, MCT invites industry professionals to download the full report.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

For a deeper analysis of these trends, download MCT’s full report: https://mct-trading.com/press-release/mct-reports-a-3-increase-in-mortgage-lock-volume-buoyed-by-refinance-activity/

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

NEWS SOURCE: Mortgage Capital Trading Inc.